2020 State of Salaries Report: Salary benchmarks and talent preferences

To access the 2022 State of Tech Salaries report, click here

To see highlights from the 2021 State of Tech Salaries report, click here

To download this report, click here

Tech salary benchmarks and how remote work is impacting talent preferencesEach year, Hired combs through hundreds of thousands of interview requests and job offers to provide the single most comprehensive view of tech salaries ever produced. For this report, we analyzed salaries for software engineers, product managers, DevOps engineers, designers, and data scientists, to empower both companies and candidates with real salary benchmarks they can rely on.

In normal times, the end result is an accurate salary roadmap for tech companies and talent—trendline they can follow for the year to come.

Of course, these are not normal times.

Against the backdrop of COVID-19, techHQ’s are closed, work from home is the “new normal,” Amazon and Netflix usage is soaring, well known tech unicorns like Uber, Lyft, and Airbnb are laying off thousands, and Facebook is floating company wide adjusted salaries based on cost of living in exchange for the ability to work remotely.

Put simply, it is still too early to tell whether the 2020 tech salary trendline will stay steady or forever be divided into “before” and“after” COVID-19. What we do know is that as companies and tech talent navigate this new normal, it’s more essential than ever to remove the stigma around salary discussions and promote transparency.

In that context, we present our first ever two-part State of Salaries report:

Part 1: Where we were before COVID-19

Hired’s proprietary career marketplace data reveals tech salary trends heading into 2020

Part 2: The next chapter: Now and where we’re headed

Survey data from 2,300 tech workers about the future of work and their compensation

Quick Shares:

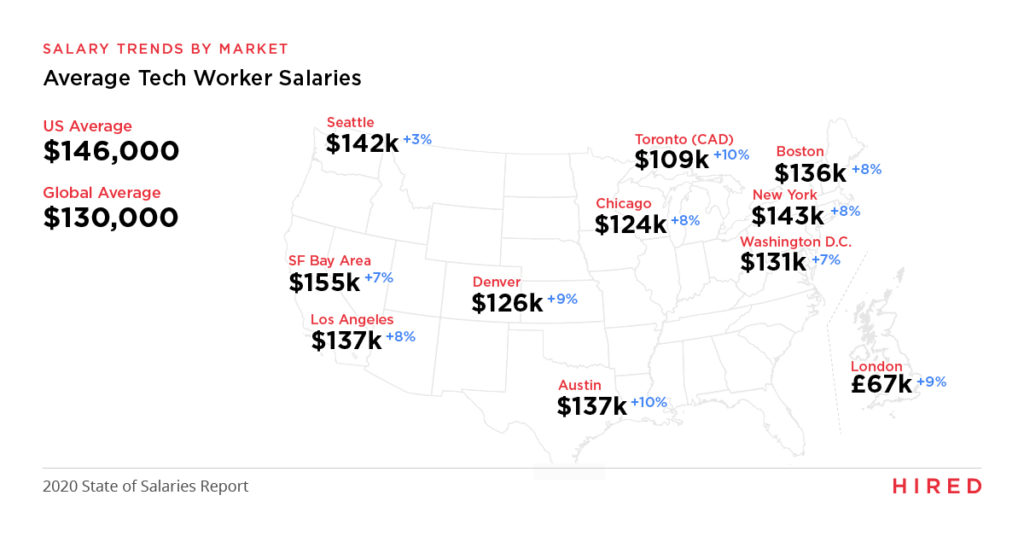

- Tech salaries grew in every major market last year, with a US market average of $146k and a global average of $130k.

- Austin and Toronto led the tech world in salary growth, as each saw a 10% increase last year.

- SF Bay Area still boasts the highest pay in tech, with an average salary of $155k, a 7% increase

over the previous year. - Seattle had the most modest salary increase at 3%, but still ranks third for highest average salaries, behind only New York and SF Bay Area.

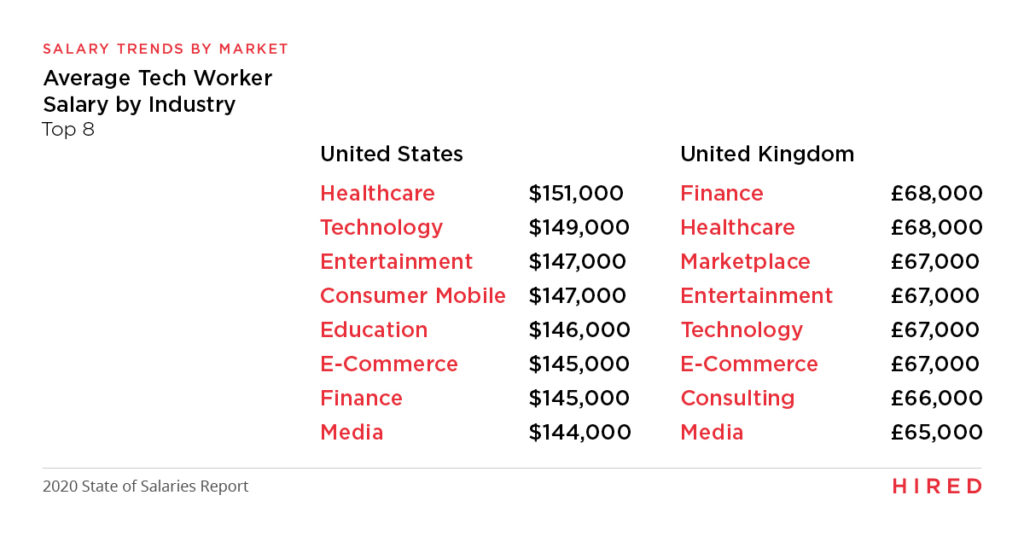

- Tech salaries in the healthcare sector are skyrocketing, with an average salary of $151k in the US and £68k ($87k) in the UK.

Roaring into the 20’s

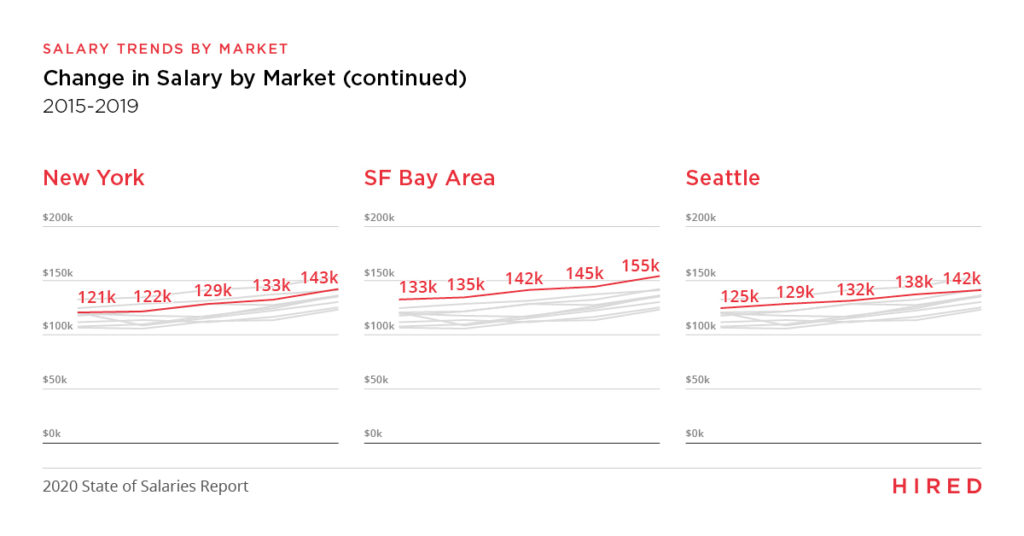

Whether salary trends continue or the pandemic creates a “new normal,” Hired data from the 2019 calendar year paints a clear picture of widespread growth in the salaries offered to tech talent. From San Francisco to London, software engineers to data scientists, everyone working in tech saw steady gains and had every reason to look forward to more of the same in 2020.

San Francisco still reigned supreme with a 7%YoY growth and an average of $155k. Seattles showed signs of slowing with just 3% salary growth—but remained the 3rd highest paying city.

Austin and Toronto led the tech world in salary growth

Tech salaries in the healthcare industry are healthier than ever

Salary growth for specific tech roles

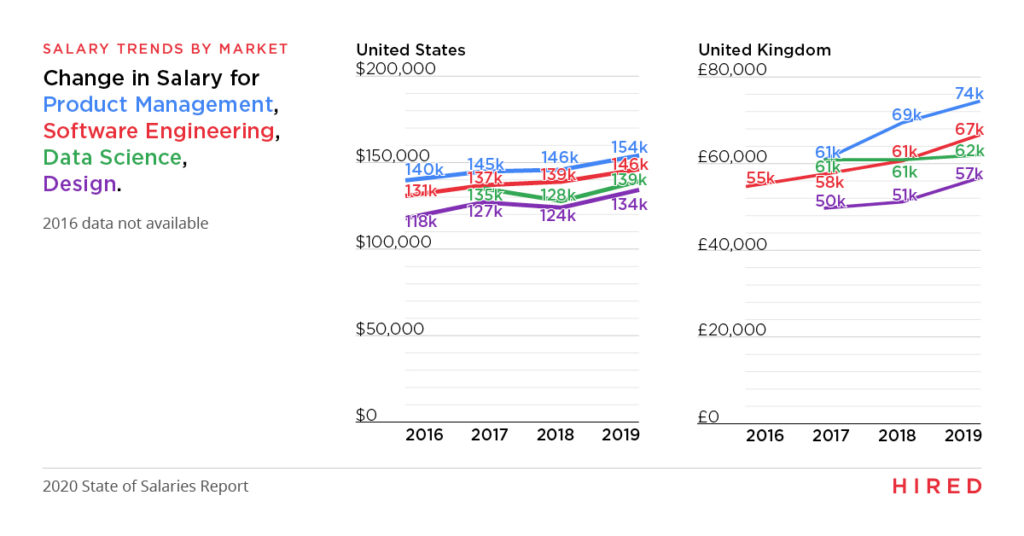

Tech talent continues to be core to a company’s operating system, driving value for innovative businesses and their compensation reflects that. We took a look at salaries specific to product management, software engineering, design and data science roles and found that salaries increased last year in every category in both the US and the UK.

In the US, data science roles saw the largest salary increase, jumping from $128k to $139k- although it’s worth noting that reflects are bound from a slight dip in 2018, when salaries went down to $128k from $135k.

And while software engineering roles are most often known for commanding top dollar, this year product management salaries surpassed them with an average salary of $154K compared to$146K in 2018. In the UK, software engineering and design roles saw the largest salary gains this year, increasing by £6k to £67k and £57k respectively.

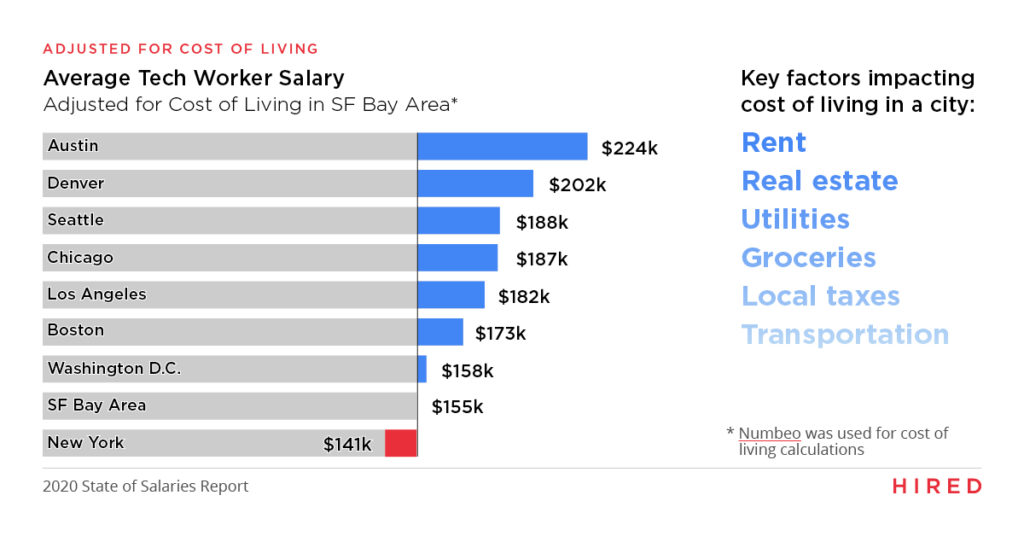

ADJUSTED FOR COST OF LIVINGHow far does your money go?

As more companies contemplate the adoption of permanent remote work policies, the age-old calculation comes up, ”If I can move to Denver, but keep my San Francisco salary…” Although this may become a reality for some, there are early signs that this won’t be the case.

Big tech has already begun laying the groundwork for their remote compensation philosophies when in May, Facebook revealed that starting in 2021, “employees may have their compensation adjusted based on their new locations,” if they plan to relocate and work remotely.

So, the question becomes: How much further do average tech salaries stretch in other cities compared to San Francisco?

While SF Bay Area talent is paid generously, it is often justified by the high cost of living they experience as well. To answer the question above, our analysis to the right considers key cost of living factors including rent, real estate, utilities, groceries, local taxes and transportation for SF and applies that to the average salary in different tech cities

So, even though you may be earning a bigger paycheck living in the SF Bay Area, your money will go significantly further in cities like Austin and Denver where your adjusted salary becomes $224K and $202K respectively.

SALARY EQUITYRacial bias and ageism: We have work to do

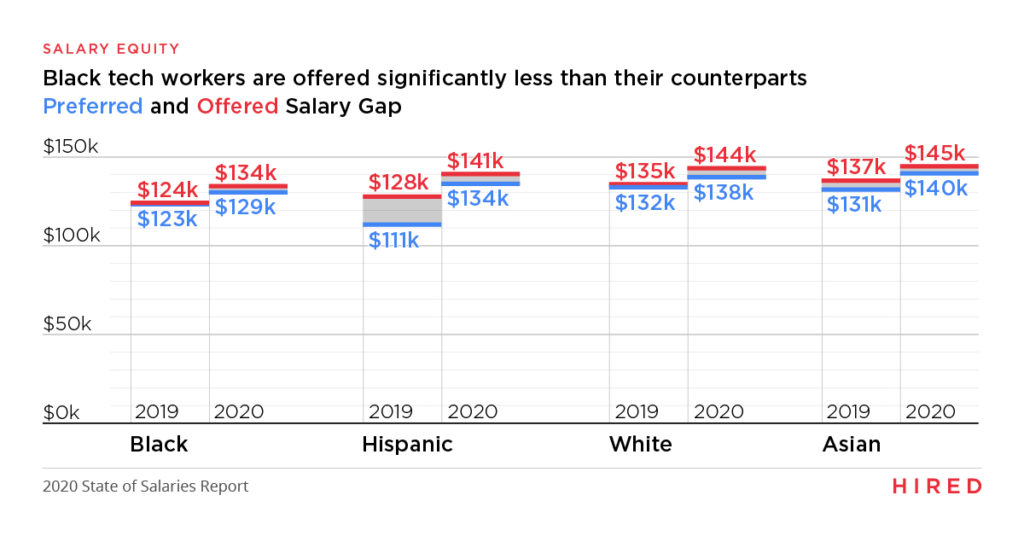

Despite the overall salary gains we saw in our 2019 data, there were still substantial gaps between white tech professionals and their Black and Hispanic counterparts, suggesting that existing Diversity, Equity and Inclusion initiatives aren’t making a meaningful impact.

The salaries offered to black candidates, while significantly higher than in previous years, were still the lowest of any racial group and $10k less on average than those offered to white candidates. Perhaps even more discouraging is both Black and Hispanic candidates continue to expect lower salaries than their white counterparts.

When a candidate creates a Hired profile, they’re required to include a preferred salary based on the skills and role they are seeking, and we found that Black and Hispanic candidates list a preferred salary that’s $9k and $4k less, respectively.

To explore more data insights on the gender wage gap, read our State of Wage Inequality Report

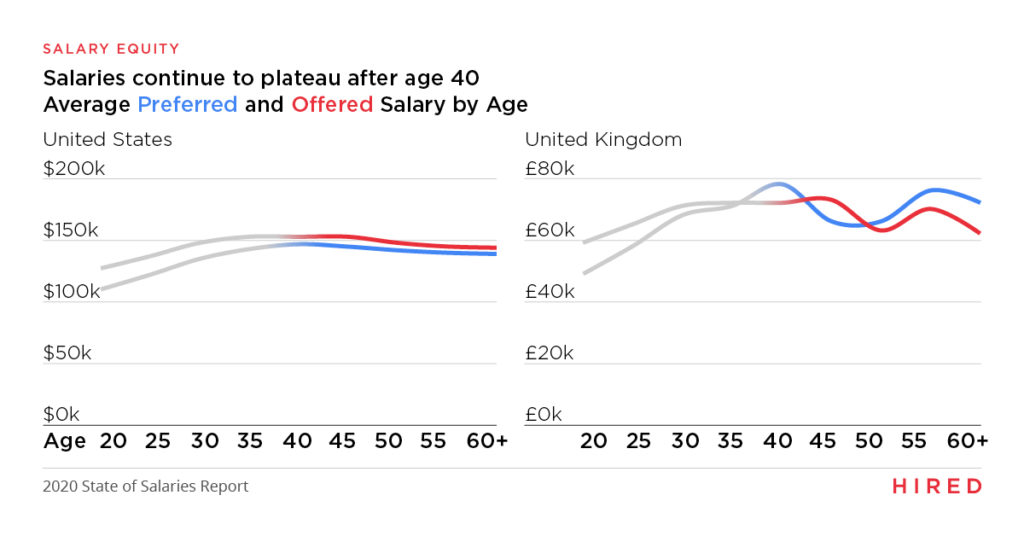

Ageism in the tech industry

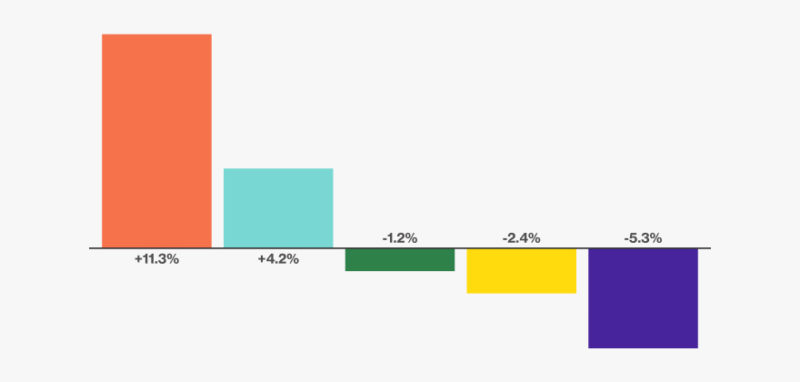

In addition to the upsetting differences in salaries offered to Black and Hispanic candidates, our data shows that salaries of candidates over the age of 45 become stagnant and often decline.

Quick Shares:

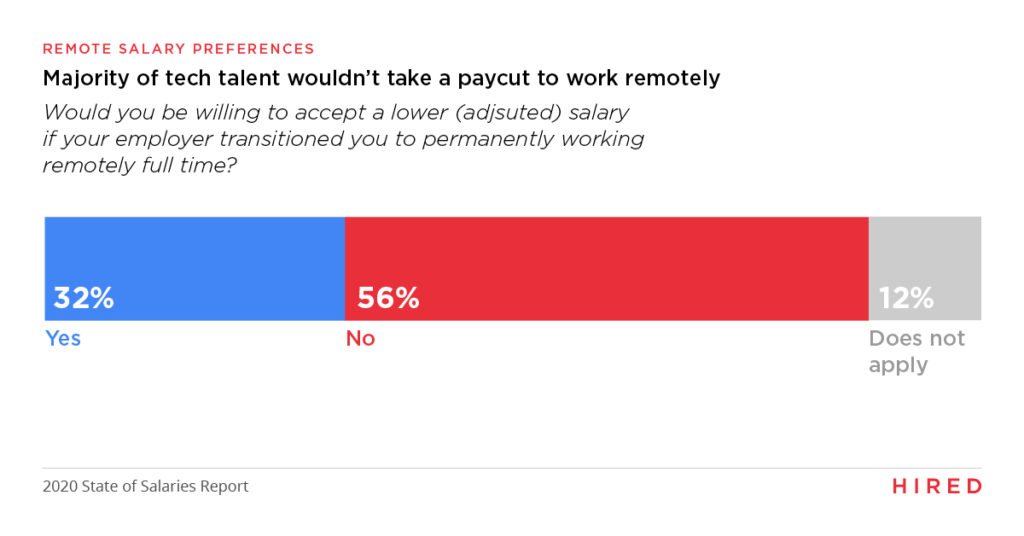

- Nearly one third of tech talent would be willing to accept a reduced salary if their employer made work from home permanent. Over half (55%) would not.

- Half of tech talent want to return to their office “at least once a week” post-COVID, but only 7% report wanting to work there every day.

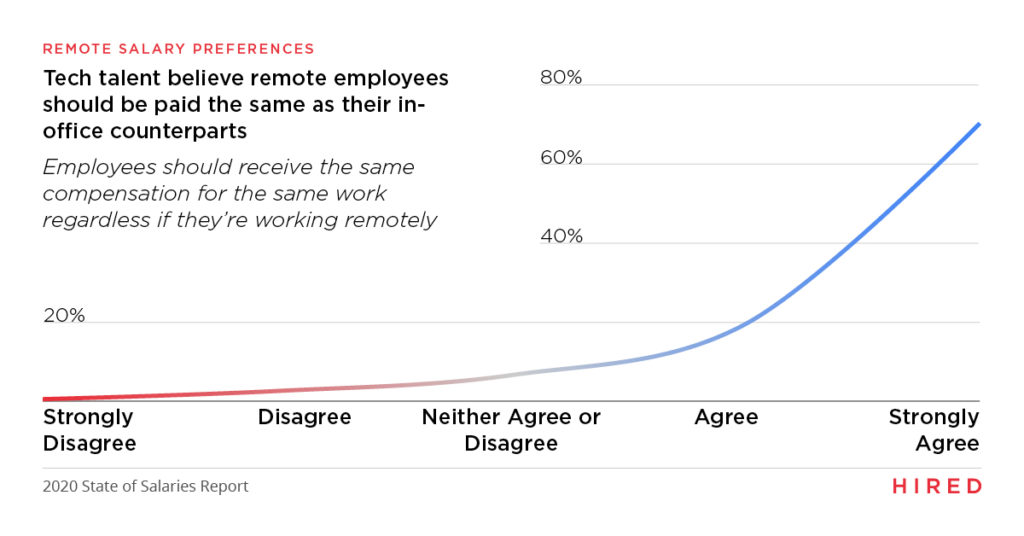

- 90% of tech talent believe the same job should receive the same pay, regardless of remote work, but, when factoring in cost of living, 40% say they support location adjustments.

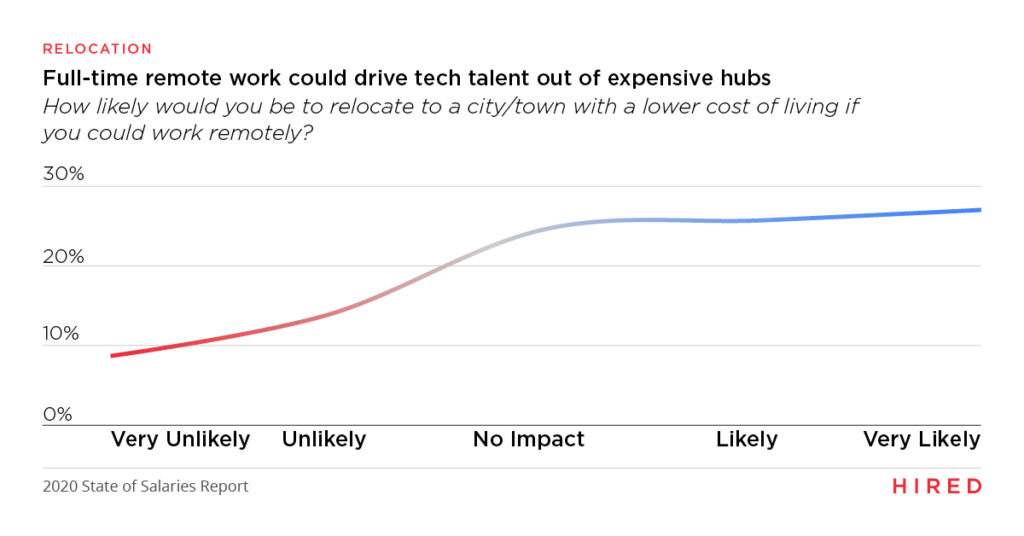

- More than half (53%) of tech workers said permanent work from home would make them “likely” or “very likely” to move to a city with a lower cost of living.

- Tech talent is split on job security, with 42% concerned, and 58% not concerned, that they are going to be laid off in the next 6 months.

Maintaining cautious confidence

While the rest of the world wrestles with an uncertain future, there has been no shortage of articles proclaiming that big tech is not just surviving, but thriving in a time of COVID-19.

Of course, the realities on the ground are a bit more complex. Based on our survey results, tech talent is split on job security, with 42% concerned, and 58% not concerned, that they are going to be laid off in the next 6 months.

They’re also divided on how confident they are in finding their next opportunity. When asked how strongly they agree with the statement ‘I want to leave my current job but am afraid to do so because I’m worried about finding another job,’ 39% of respondents strongly agree or agree, while 34% strongly disagree or disagree, and the remaining 27% neither agree nor disagree.

While fears of layoffs and furloughs pose as the worst case scenario for many in tech, the vast majority of tech talent do not expect their salaries to decrease in the next 6 months. In fact, nearly half (49%) of tech workers expect to receive a raise of up to 20% in the next 6 months, while 44% expect their salary to stay the same.

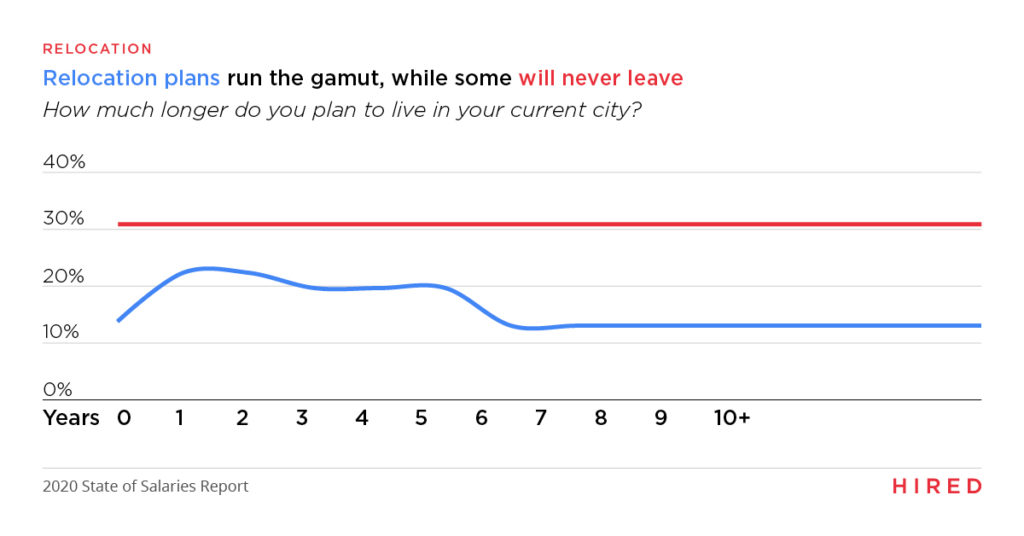

RELOCATIONCost of living leads to wandering eyes

As work from home takes hold, tech companies and their workforces are contemplating the need for centralized HQ’s optimized for collaboration rather than heads down productivity. From the company side, the benefits of reduced overhead and access to a larger, more diverse talent pool are clear, and many think that workers are itching to leave expensive urban centers in search of lower costs of living.

Our data suggests that may not be the case. When asked how much longer talent expects to stay in their current city, 31% say they have no intention of ever leaving, and 64% plan to say for another 3 years at least. For those thinking of leaving, cost of living is the 2nd most cited factor after a desire to “experience a new city.”

That said, if you ask talent how permanent work from home would impact their desire to seek out a lower cost of living, we see a shift from many who were not likely to leave any time soon, with more than 53% stating they would be more likely to make that move.

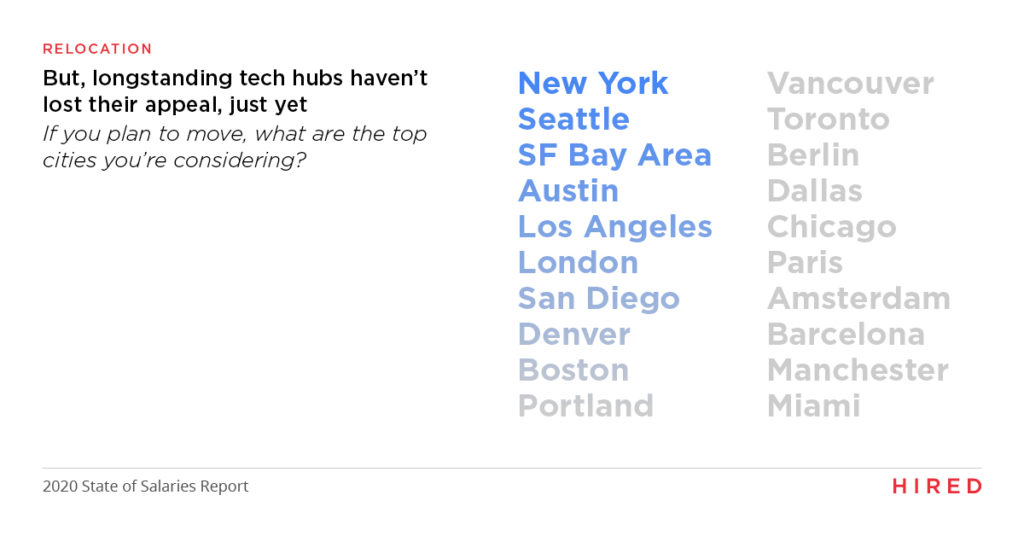

We wanted to gain a better understanding of where tech talent would consider relocating to, so we asked them to write in the city they’re most interested in rather than giving them a list of options to mitigate any potential bias. Interestingly—and despite concerns about cost of living—we saw the longstanding, expensive tech hubs come up again and again.

Pay should be adjusted, but not for me

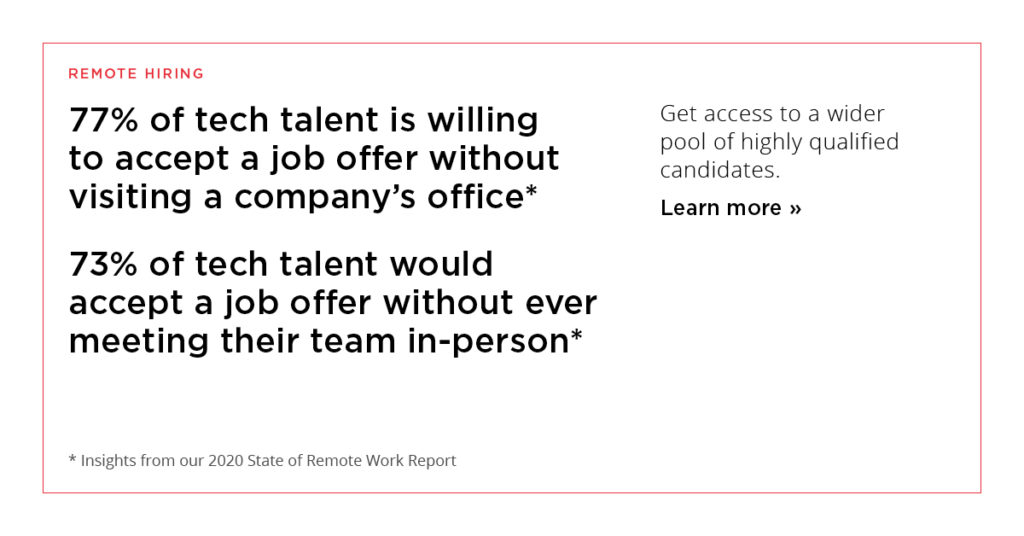

In the most general sense, tech talent is nearly unanimous in its belief that the same job should be equally compensated, regardless of work from home status.

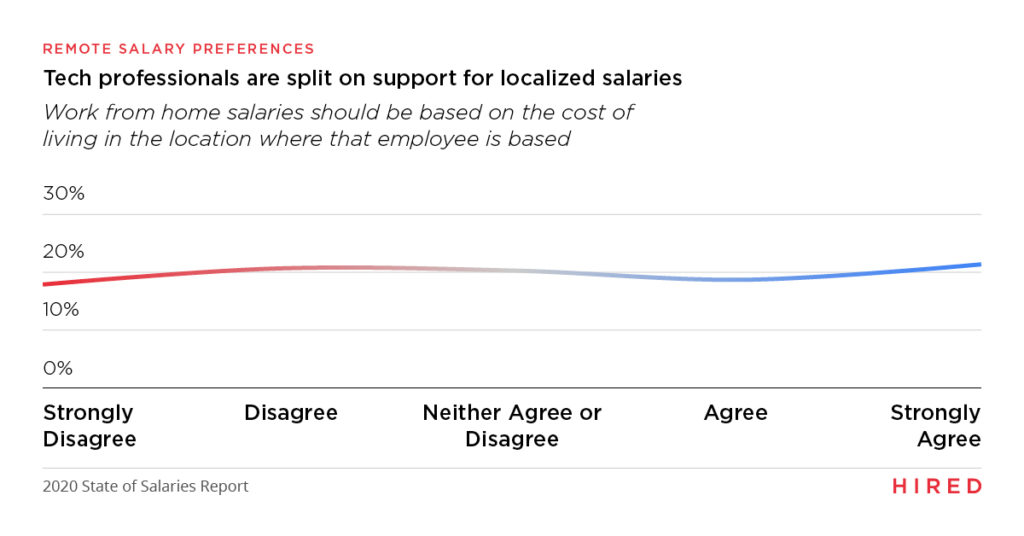

But in the current climate, Facebook is making early moves to establish a remote compensation philosophy that aligns with a different approach by announcing plans to make “cost of living” adjustments to salaries across the board. Taken in the abstract, support (or lack thereof) for adjusted salaries is spread fairly evenly: with ~40% supporting and ~40% against.

So, tech workers agree that people should be paid the same wages for the same work, but they’re more split on the idea of cost of living adjustments—what happens if we bring the question to their doorstep? How many would be willing to accept a lower salary if their employer moved permanently towards work from home?

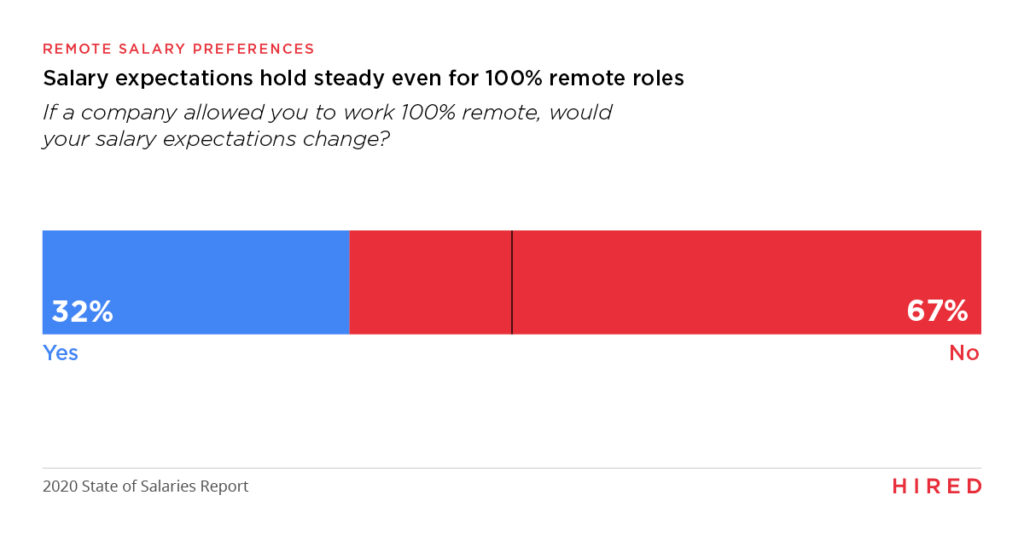

Our insights revealed that there is far less of a split, although notable that 32% of respondents said they would be willing to accept a lower salary to work remotely. Similarly, if they were starting a new job with a company that allowed them to work 100% remote, two-thirds (67%) of tech professionals’ salary expectations would not change, while a third (33%) said they would.

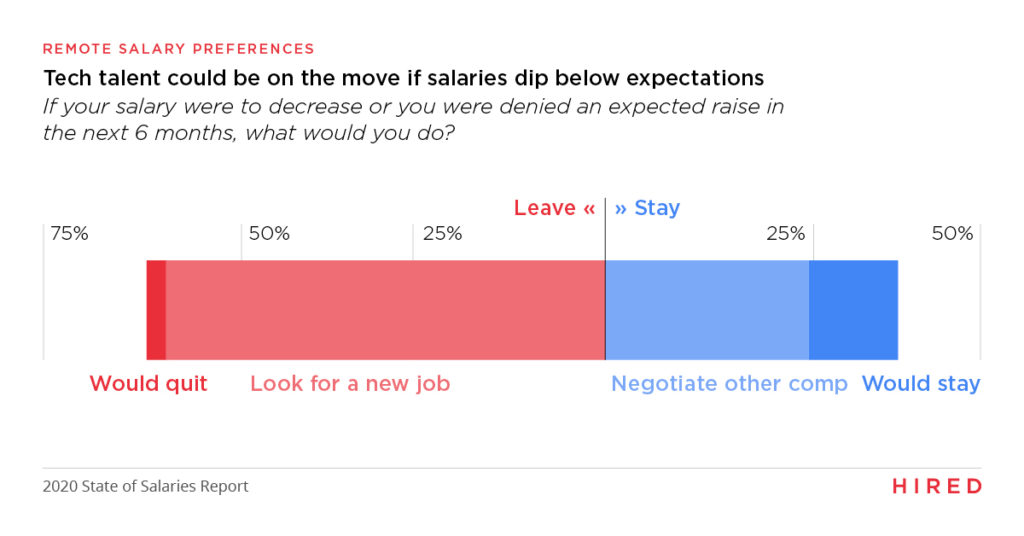

And, most tellingly, over 60% of those interviewed said that they would immediately start looking for a new job (or even quit) if they were denied a raise or if their salary decreased in the next 6 months.

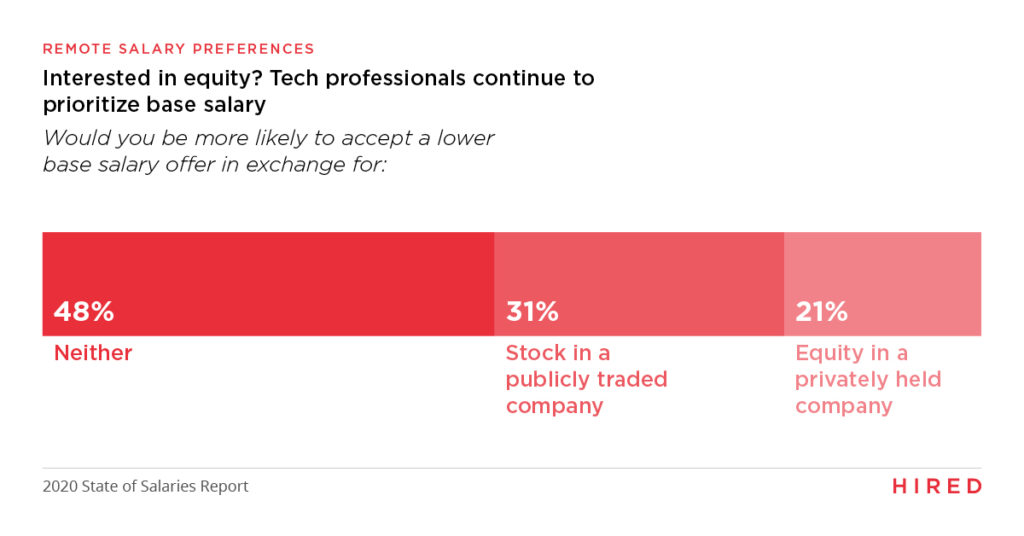

And if employers think they can dangle more equity and stock options to convince a candidate to accept a lower base salary, they may want to think again.

Our most recent Brand Health Report found that base salary is the most important factor in a candidate’s decision to accept a job, and that seems to ring true today, as tech talent are divided on what salary sacrifices they’re willing to make. 31% of tech professionals said they’d accept a lower base salary in exchange for stock in a publicly traded company and 21% said they’d take a lower salary for more equity in a privately held company, but nearly half (48%) said they wouldn’t take a lower salary for either.

Rather than offering stock or equity, companies should consider upgrading their health, dental and vision benefits, which tech talent ranked as the number one most compelling benefit beyond base salary. This was followed by unlimited PTO, paid parental leave, free childcare services, tuition reimbursement, free gym membership, and student loan assistance.

Retention tension

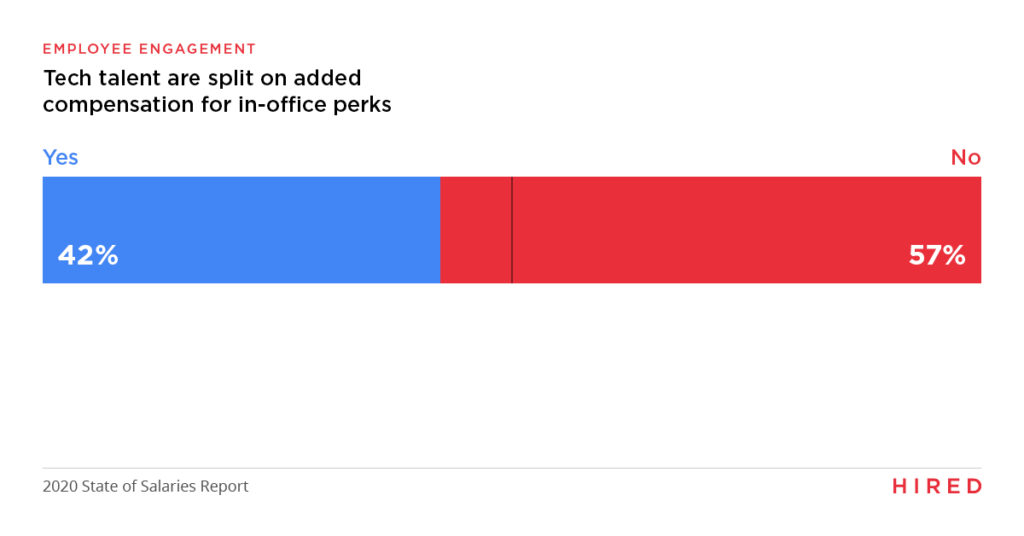

While the majority of tech professionals we spoke with wouldn’t take a pay cut to work remotely full time, we found that 57% would be willing to forgo added compensation equal to in-office perks like, free lunch and fitness classes, but the remaining 43% would expect that added compensation.

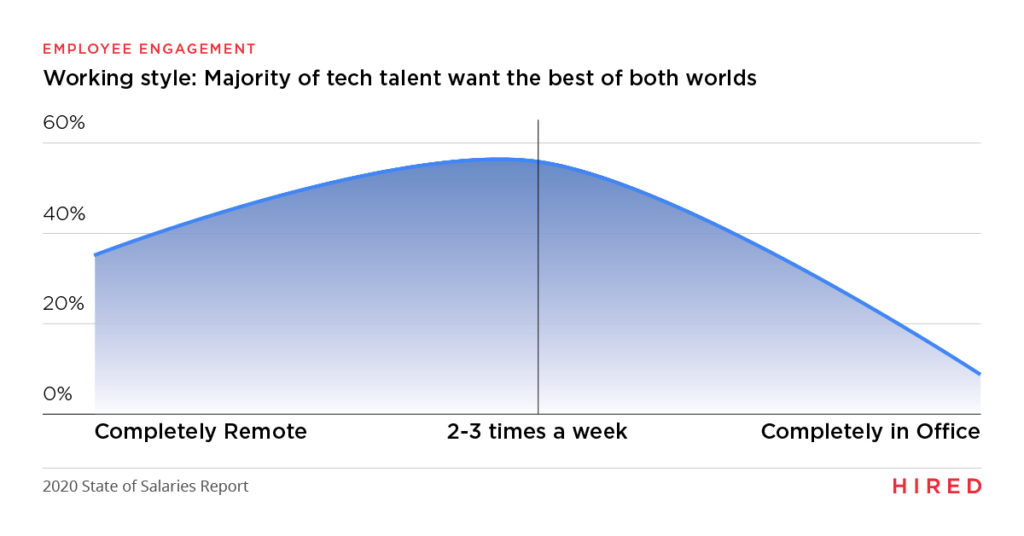

As far as how tech talent want to work in a post-COVID world, a third of the tech professionals we surveyed want to work remotely regardless of where they’re located, while 11% want to work remotely, but only in the same time zone as their team or company.

On the flip side, a full half of tech professionals want to work from the office at least one day a week, while just 7% want to work exclusively from the office.

When explicitly asked if they want to return to the office post-COVID, 35% of respondents said they’d rather work remotely full-time, while 56% said they want to be in the office 2-3 times a week, and the remaining 9% want to be in the office full-time.

All of this indicates that while most tech professionals are comfortable continuing with remote work to some degree, many of them still value having an office to return to on their own terms.

That’s why we’re likely to see companies embrace remote work in the way it works best for their business and workforce, and that’s going to vary depending on their unique needs.

Some companies may decide to have certain teams come into the office once a month for in-person collaboration and work remotely otherwise. Others may opt to build distributed teams, but have them operate in the same time zone. It’s all about finding the right balance for your business, and clearly communicating your remote work policies to employees.

Conclusion

We firmly believe that transparency around salary data is critical for empowering tech talent to not only find a job they love, but to take that job knowing they are being compensated for the true value of their work.

While last year was an undeniably big year for tech salary growth across the globe, it’s still unclear how the pandemic will impact salaries long-term, which makes publishing this report even more important.

As tech talent and companies navigate the new normal, we must continue to have meaningful, transparent conversations around salary and compensation—particularly with regards to how remote work will impact the shifting tide.

While tech talent have varying preferences on what style of remote work is best for them —be it working from home while having access to an office or being remote full time—it’s clear that COVID-19 has been a catalyst for the wider adoption of remote work across the board.

What’s less clear is how willing they are to take a pay cut to do so, and how their expectations will evolve. As a first step, companies should prioritize not only solidifying their remote work policies but taking the time to define how they plan to approach compensation in a more remote-centric world in order to attract and retain today’s top tech talent.

Although we are in the early days of this new chapter, and there’s inevitable uncertainty about how the tech industry will evolve in the years to come, one thing remains certain: the need for salary transparency.

At Hired, we are committed to quantifying the ever-changing state of salaries in tech and hope that our dedication to data transparency will help job seekers and the world’s most innovative companies make more informed decisions as we strive to build a more equitable future.

To download this report, click here

Methodology

This report is based on Hired’s proprietary data from real job offers on the platform from companies to tech professionals, collected and analyzed by Hired’s data science team. For this report, we focused on tech talent in 11 markets and analyzed more than 425,000 interview requests and job offers facilitated through our marketplace during the last year, including more than 10,000 participating companies and 98,000 job seekers. Age and race data was collected through an optional demographics survey given to Hired candidates that is used only for aggregated research purposes and not shared with Hired clients. Where numbers have been adjusted to reflect cost of living in a certain market, we used data from the site Numbeo, which factors in things like rent and real estate prices, groceries, transportation, utilities, local taxes, and more. In addition to our proprietary data, we collected survey responses from more than 2,300 tech professionals across the globe on the Hired platform to better understand how COVID-19 has impacted their salary expectations, desire to work remotely, perception of job security, and more.

Related blog posts

Hired Expands to Help Companies Find Talent Worldwide as Demand for Remote Work Doubles

With over 60% of companies on the platform hiring remotely, Hired now connects them with qualified...

Hired Releases “2021 List of Top Employers Winning Tech Talent”

AI-driven tech and sales career marketplace Hired ranked US and UK companies across equity,...

Hired Releases 2022 State of Software Engineers Data Report

Annual State of Software Engineers report shows remote salaries are up; Go is the most in-demand...

Hired Releases 2022 State of Tech Salaries; Navigating an Uncertain Hiring Market

Salaries for tech candidates remain at an all-time high with remote salaries outpacing local...

Hired Releases its 2022 State of Wage Inequality in the Tech Industry Data Report

The gender and race wage gap is narrowing, but access to opportunity and discrepancies in salaries...

One Team One Dream Corporate Offsite in Las Vegas Wins Big

After two long years, employees gathered at the Paris Las Vegas Hotel for the first corporate...