Talk:Wikimedia Endowment

Update and Thank you!

We launched the WIkimedia Endowment! In case you missed it, you can read the announcement here. Thank you to everyone here who offered their thoughts and suggestions. This discussion very much guided the decisions we have made so far. There are still a lot of decision to be made about the endowment over the next 6 months or so, and I will continue to post questions as they arise. I hope you will continue to offer your guidance. Thanks, again. --Lgruwell-WMF (talk) 18:03, 27 January 2016 (UTC) Note: The board resolution creating the endowment is on Office Wiki.

Update #2: Annette Campbell-White has been named as a founding member of the Wikimedia Endowment Advisory Board. The announcement is here. --Lgruwell-WMF (talk) 00:42, 12 May 2016 (UTC)

Update #3: We received a $1 million gift to the WIkimedia Endowment from Craig Newmark! The announcement is here. --Lgruwell-WMF (talk) 14:22, 8 June 2016 (UTC)

What should be the strategic purpose of a Wikimedia Endowment?

Some ideas, not all compatible:

- Critical infrastructure and uptime: minimum viable levels of hardware, bandwidth, release & testing. Investment in distributed solutions - to reduce the cost of this infrastructure over time - might count as well.

- Preserving and amplifying the spirit of Wikipedia, whether or not that means 'current projects' or 'something like a Foundation' For comparison, see the Knight Foundation and its history - it has long outlived its parent Knight-Ridder corporation. So a WM endowment could support a similar permanently relevant vision: 'startup costs for volunteer-run knowledge projects', or 'access to commons-focused curation efforts'. 213.197.255.102

- To secure that the content will be preserved, independant on technological upheavals that the future could bring.Anders Wennersten (talk) 17:23, 30 November 2015 (UTC)

- I'll pivot on this question a bit and ask the equally important question of what would be the limits of Endowment usage, the WP:NOT of our approach? When would funds be 'off limits', for which kinds of projects, from which donors, for what nature of activiites...? Ocaasi (talk) 21:25, 30 November 2015 (UTC)

- to provide a financial foundation to pursue the wikimedia vision and mission. Slowking4 (talk) 00:42, 1 December 2015 (UTC)

I'll suggest several levels of goals, from "absolutely achievable" to "it would be very nice if we could do this" with an overall theme of assuring our participants, partners, and employees that we going to be here for a long time are will be able to fulfill our long-term commitments "no matter what happens".

What type of event would require us to use the money from an endowment? Well we do need to limit when we can use the funds to specific purposes, mostly when the Board declares a state of EXIGENCY (a state of affairs that makes urgent demands) - I believe that's the usual word used - something like "bankruptcy" as used for non-profits.

This would most likely come about because of a major change in government regulation (perhaps e.g. relating to copyright liability or anonymity) or technological change. Looking at tech change, consider that broadcast TV was the dominant platform of mass communication for 50 years, but now it is the internet or mobile platforms that are dominant. Change happens faster now, so is Wikipedia going to be able to adapt *when* (not if) the change comes whether that's 10 or 50 years from now? These changes could potentially cut off all annual donations.

- level 1 - keeping our content on-line and available to the public for at least ten years, with a skeleton Board and legal staff. absolutely achievable, cost per year - maybe $500,000/year or $5M in the endowment.

- level 2 - keeping Wikipedia open to receive new content for at least 10 years. achievable. would require tech staff to fix any everyday glitches, perhaps new server capacity from time-to-time. Maybe cost $4M per year or about $35M in the endowment (can't find a good financial calculator right now)

- level 3 - adjusting from full scale operations to level 2 operations over 2-3 years, in case of legal or technologic obsolescence. Give employees some confidence that they'll still have work next year, even in the worst conditions. Challenging. Say $75M in the endowment.

- level 4 - keep near "full scale" operations going for 2 years in case of a temporary disruption in funding or a sudden shift to a new platform to allow the WMF time to adjust to a seemingly impossible situation. It would be nice if we could do this. Say $100M in the endowment.

That adds up to about $215 million. "Challenging, but achievable" Of course there will be interest, dividends, or realized capital gains, on this every year, but that might be about $5-10M, which could be dedicated to keeping the servers open. The IRS demands that a certain % (about 5%) of the endowment be spent each year in order to maintain non-profit status so that would be covered by keeping the servers open. Smallbones (talk) 18:35, 2 December 2015 (UTC)

- I haven't weighed in on this page before, but would like to make this point, which I think is implicit in many of the comments above:

- In a context of widely varying views of what is "necessary" to Wikipedia and Wikimedia, the absence of clear principles guiding dollars kicks a crucial can down the road. This is an English idiom meaning: if we don't solve this problem now, we will have to solve it later. It is easy to predict that the moment the first major expenditure is made (regardless of what it is), there will be controversy and pushback. That can be avoided by careful planning now, but will be a big problem if left for the time of expenditure, when there will be an emergency (in someone's view). Unity will be a key need at that point, but unity will be difficult to find if there is not clear alignment about the mission, strategy, or purpose of the endowment fund. -Pete Forsyth (talk) 17:13, 25 January 2019 (UTC)

- Thanks for the comment Pete. We used this discussion here in 2015 to define the strategic purpose of the Wikimedia Endowment, which is "to act as a permanent safekeeping fund to generate income to support the operations and activities of the Wikimedia projects in perpetuity." This has to be sufficiently broad because we cannot anticipate the financial needs of the projects 20, 50, 100 years in the future. That said, we would love to hear what you are thinking.--Lgruwell-WMF (talk) 00:02, 7 February 2019 (UTC)

How large of an endowment should we try to raise in the next 10 years?

- 20x the current annual cost of the strategic purpose would allow for that work to be covered by interest. 213.197.255.102

- 20x the cost of runnign servers etcAnders Wennersten (talk) 17:23, 30 November 2015 (UTC)

- WMF already has a reserve of such an amount... Running servers costs between 2 and 5 M$ and the reserves are above 60. Nemo 18:45, 30 November 2015 (UTC)

- I also include personell to do very basic updates and adjusment of a frozen mediaWiki (or coresponding platform) some basic upodates of content and of course a legel support unit. Say 10-15 M$ pe year which would make the total endowmnet of 200-300 M$.Anders Wennersten (talk) 20:29, 30 November 2015 (UTC)

- WMF already has a reserve of such an amount... Running servers costs between 2 and 5 M$ and the reserves are above 60. Nemo 18:45, 30 November 2015 (UTC)

Do you think Wikimedia Foundation and/or Wikipedia will be relevant forever (or at least for the very long term) and should remain in existence for perpetuity? Why or why not?

- The knowledge will be, at least as a snapshot of the current state of public knowledge. 213.197.255.102

- I am very open the organisation behind content will be very diffrent, also that the technical storage behind the content will be different. But I do beleive most of the content will be of value för the very long terrm, even if it will be needed o package differently.Anders Wennersten (talk) 18:29, 30 November 2015 (UTC)

- no, the mission will remain forever, but wikipedia may well become moribund and irrelevant like wikinews. the open licensing makes the material reusable indefinitely, and the WMF could pivot to other open initiatives, or it could have a wind up plan based on certain criteria. Slowking4 (talk) 00:39, 1 December 2015 (UTC)

- the content will very likely be relevant for a very long time, but the WMF will not necessarily be the "owner", supporter, or guardian of it. The WMF could, in theory, fail fairly quickly - maybe in 5 years if it really tries! Then another organization or organizations would likely take over the content and use it in ways that we never expected. That could be good or bad, but it would certainly be disruptive. In the intermediate term (10-50 years), it's probably best that the WMF take its legacy and run with it as far as it can. Let's not plan for perpetuity, we'd be sure to fail. More importantly, if we plan for more than 20-30 years, we're very likely to become a very conservative, fat and lazy organization. Let's continue to change the world, let's continue to change ourselves. Smallbones (talk) 19:39, 2 December 2015 (UTC)

Is it more important for WMF to use a portion of funds to support the future needs of the organization than some current needs?

- Yes. In particular, only a small portion of current needs are critical to the projects; the rest are attempts to find new solutions or audiences or answers to unsolved problems. Some funds should ensure that the critical elements continue to be supported even if the rest fails.

- It is also important for the movement to have funds in a trust that isn't entirely devoted to the current conception of the WMF. An endowment can ensure continuity over time, across similar institutions. 213.197.255.102

- I would worry that an endowment acts against that continuity path by further centralizing who has control of the money. If WMF were to go under, the successor owner of the endowment might or might not be in line with what the community wants. --brion (talk) 17:35, 30 November 2015 (UTC)

- Indeed, I'd never trust WMF with tens of millions dollars, let alone hundreds. See Wikimedia Trust for some thoughts on the matter. Nemo 18:42, 30 November 2015 (UTC)

- I would worry that an endowment acts against that continuity path by further centralizing who has control of the money. If WMF were to go under, the successor owner of the endowment might or might not be in line with what the community wants. --brion (talk) 17:35, 30 November 2015 (UTC)

- Yes.Anders Wennersten (talk) 18:29, 30 November 2015 (UTC)

- yes, although not clear there must be a choice. fund-raising is above goal; WMF is not money constrained. Slowking4 (talk) 00:33, 1 December 2015 (UTC)

- Yes, an endowment is all about the future - the unexpected future. If something nasty happens, as it inevitably will, Wikipedia can continue. 5% spending of the balance each year is required by the IRS, and that could be used for the very basics- i.e. running the servers. Smallbones (talk) 04:31, 3 December 2015 (UTC)

- Please note that there is a difference between a public charity and a private foundation. The private foundations carry the 5% spending requirement. Hlevy2 (talk) 14:56, 13 August 2019 (UTC)

How should we go about raising an endowment?

- Two small ways: 1) designate half of any windfall income (e.g., single unsolicited donations or prizes over $50k) to the endowment. 2) encouraging commitments by family foundations and individual estates 213.197.255.102

- This question would be easier with pointers to promising options.

- Decrease the operating costs of the Wikimedia Foundation, such as by moving to a more economical locale than San Francisco, and move some of the savings into an endowment. --Pine✉ 05:15, 28 November 2015 (UTC)

- Intentionally overshoot the necessary Annual Plan revenues by a small amount such as 10% each year, and move the savings to an endowment. Cease adding funds to the WMF operating reserve. --Pine✉ 05:15, 28 November 2015 (UTC)

- Discuss options with large foundations that are in a position to grant large amounts of money for an endowment, and might be willing to give (1) their expertise in raising and managing endowments or (2) their funds to the WMF endowment. --Pine✉ 05:15, 28 November 2015 (UTC)

- I would discourage doing a new mass-marketing campaign like the annual online and email fundraisers in order to fund the endowment. Those donor sources can continue to be contacted for the operating budget and Annual Plan once per year. At most, intentionally overshoot the AP goal by 10% annually, as mentioned above, and direct the excess to the endowment. --Pine✉ 05:15, 28 November 2015 (UTC)

- i would take a portion of reserves, and add those gifts from donors designated endowment. Slowking4 (talk) 00:32, 1 December 2015 (UTC)

- I'll be completely different here, though see Theo's Review below.

- We could shoot for the whole sum within a few years, essentially a one-time campaign to raise $200M-250M.

- This is not the huge sum it seems - for example the Akron Ohio Public Schools spend about $300M per year -isn't the foreseeable future of Wikipedia worth as much to education as one year of Akron Public Schools? Well it might be hard to compare the two. How about the endowment of a median sized US university. If I read the essay correctly, it's about this amount. How about the money available - well Zuckerburg just pledged to give away about $400 billion over his lifetime. Given the world-wide reach of Wikipedia, it's likely we can raise this amount.

- Being located near Silicon Valley, Wikipedia has access to many new billionaires. Folks in the tech and venture capital industries likely realize that Wikipedia is a major part of the ecosystem that helped them make their money. These folks are the biggest spenders in philanthropy now and likely for the next 30 years.

- These folks are likely to want to donate stock rather than cash (for tax benefits) - and it would be reasonably easy for Wikipedia to help them do this.

- Yes, we have access to many small donors, and I'd think many would be happy to donate in order to assure a lifetime of Wikipedia, perhaps in a special Summer endowment drive, or in an extra week following the regular winter campaign.

- I should go see how many $250 million endowment campaigns were launched this year. I'll guess 5-10. I'll be back. Smallbones (talk) 05:13, 3 December 2015 (UTC)

- Actually, without a subscription to the Chronicle of Philanthropy, where am I going to get that information? But the 1st number I saw from my search there was "Cranbrook Educational Community (Mich.) (start of campaign) Nov. 2006 (closing date) June 2010 goal $150,000,000" Cranbrook is a big private school. I think Mitt Romney went there - they've got lots of friends. We have more. Smallbones (talk) 05:22, 3 December 2015 (UTC)

- OK, I've got some better idea now - from a 2011 article in the Huffington Post there were 10 non-profits (see slideshow) that raised more than $750 million the previous year. United Way headed the list and most of the non-profits everybody knows, but surprisingly about 3 or 4 would not be recognizable to most people. So if we want $250 million (one time) and other relatively unknown non-profits get over $750 million, it definitely looks like we'd have a good chance. Smallbones (talk) 21:44, 4 December 2015 (UTC)

- Actually, without a subscription to the Chronicle of Philanthropy, where am I going to get that information? But the 1st number I saw from my search there was "Cranbrook Educational Community (Mich.) (start of campaign) Nov. 2006 (closing date) June 2010 goal $150,000,000" Cranbrook is a big private school. I think Mitt Romney went there - they've got lots of friends. We have more. Smallbones (talk) 05:22, 3 December 2015 (UTC)

- I should go see how many $250 million endowment campaigns were launched this year. I'll guess 5-10. I'll be back. Smallbones (talk) 05:13, 3 December 2015 (UTC)

Where and how to invest the funds of the endowment

My rough understanding is that when you have an endowment, you're basically keeping a bunch of money in the bank, invested in some way such that the money in the bank increases over time -- then you can skim some of that investment profit back off for current operating costs over time.

This leaves an open question: what businesses should we invest the money in?

This is not a small question. Fundamentally we're asking people to give money not to Wikimedia Foundation to spend on Wikimedia movement goals, but to spend on other peoples' businesses with the goal of making a profit, which will eventually help fund Wikimedia movement goals.

Would we review endowment investments for social as well as fiscal responsibility, and how much extra effort and infrastructure will that require? --brion (talk) 17:32, 30 November 2015 (UTC)

- Socially responsible investment funds are common by now and is proven to perform better than irresponsible funds. See some references at User:Gnom/Environmental_impact#Have_a_green_energy_investment_strategy. Nemo 18:40, 30 November 2015 (UTC)

- It's worth noting that keeping money in a bank account that earns interest is essentially doing the same thing, but with less choice over where the money is invested (and at the same time, a much higher guarantee of return of investment). I suspect that ethical investments would return less than unethical ones... Thanks. Mike Peel (talk) 20:40, 30 November 2015 (UTC)

- i would expect that the WMF can invest using modern portfolio management. given the tax status, there may be a bias towards high income investments. there is no ethical fund for open companies, maybe the WMF would consider starting one. no reason to put on limitations. a little improvement in financial reporting would be nice. Slowking4 (talk) 00:30, 1 December 2015 (UTC)

- Your suspect is proven wrong. :) Nemo 11:59, 1 December 2015 (UTC)

- I'll claim some expertise here, having a PhD in Finance and having taught finance and investments for 20 years. "Ethical investment funds" do not outperform index funds in any study that I've seen. There's a good reason for that. If you are trying to maximize anything, the fewer constraints you put in the problem, the higher the maximum will be. So if we want to maximize expected returns then we should not limit our investment choices. If we get "a psychic return" from not investing in some things, then we will (on an expected basis) have to pay for it with reduced actual monetary returns. If you want to help somebody, don't fool yourself that you won't have to sacrifice something to do it.

- What we really need as an investment strategy is low fees and transactions costs. I know this sounds boring which is perhaps the reason so few people try to do it, but it makes a huge difference. Say we pay 50 basis points (0.5%) for management - this or even lower is available via the Vanguard 500 fund or a few others - we'll do much better than with other funds that typically charge 1.50% or more per year. How much better? I should go check the figures, but it's something like 50% of the increase in the theoretical value of fund (not including fees) goes to the manager over 15 years. Why? Well the percentage fee is paid on the whole fund (not just on the increase), it is charged every year and it compounds.

- Index funds - as broadly based as possible - are the way to go - to minimize fees and transaction costs and also reduce risk. Smallbones (talk) 20:15, 1 December 2015 (UTC)

- i agree, although there are a few investors who can outperform indexes such as swenson, and buffett. however, there is the question of which index, s&p, russell, global, or world? Slowking4 (talk) 20:04, 23 December 2015 (UTC)

- It's worth noting that keeping money in a bank account that earns interest is essentially doing the same thing, but with less choice over where the money is invested (and at the same time, a much higher guarantee of return of investment). I suspect that ethical investments would return less than unethical ones... Thanks. Mike Peel (talk) 20:40, 30 November 2015 (UTC)

- Hi User:Lgruwell-WMF, thank you for sharing more information about the current investment strategy! Is there a public source for this information that we could link to? Thanks, --Gnom (talk) Let's make Wikipedia green! 18:31, 13 September 2017 (UTC)

- Hi Gnom - Unfortunately, there is nothing on Tides website that I can link to right now. However, they are launching a new site soon and I think we will be able to do so then. I'll keep you posted! Thanks! --Lgruwell-WMF (talk) 19:25, 13 September 2017 (UTC)

Relevant stuff

- The original Endowment/fund proposal from 2009 - I guess this is the first time the $100M figure was proposed with a 2-5% annualised yield. I don't think that is feasible anymore.

- Suggested Financial strategy A slightly more improved version - seems like someone skimmed it for this essay. ;)

Regards. Theo10011 (talk) 20:28, 2 December 2015 (UTC)

Review

This endowment was kind of something I felt strongly about a long time ago. If Lisa Or Lila see this, I don't mean to direct this critique at anyone or sound glib about some of the questions in the essay - but just provide some unadulterated feedback. Personally, the essay could have done well with lesser quotes. Most of those quotes apply to traditional non-profits whose causes are more apparent and traditionally charitable. Lest we forget, WMF is a hybrid tech company based in SF, a traditional non-profit approach would conflate those two identities. Traditional non-profit advice or college endowment strategies wouldn't be very relevant.

- The essay asks "Defining a Strategic Goal for an Endowment" - Answer - Financial Sustainability and prudent financial planning. We don't need larger loftier goals, how about we start with just being better financial planners. We can see where things go, once we get there.

- Determining the Right Size of an Endowment - I disagree with the psychological impact stated while quoting warren buffet - I read it as being afraid to have too much money at disposal or being too good at raising an endowment. Both of those suppositions are predicated on the fact that its easy to raise an endowment and without set limits we will end up raising billions. Getting way far ahead of where we need to be.

- Affecting the annual fundraising and donor backlash are again issues that are problems already. We already have constant complaints about the annual fundraiser - from banners to targets, and donors already feel betrayed by the mixed emotional messaging that create urgency. Both those things are actually problems and things that make us dishonest - an endowment moves us away from that and makes us less and less reliable on the annual fundraiser - good things as far as the community and donors are considered. No lies, no banners, no urgency or emotional appeals.

- I am not sure about endowment being two size the operational budget - it sounds ludicrous. Probably a mistake. A 5% yield taken out annually would mean an endowment size that is more than 20 times the op budget? ($100 million endowment target is way too low. You would be lucky to get 2-3 million an year, which might not even consider hosting cost let alone a single staff member on top of it.)

- The point about small donors - we already have recurring donations that disappear every year from small donors. They are the backbone of any non-profit fundraising. Offsetting fall in small donations, which make up the bulk of wikimedia revenues, makes the case that we desperately need an endowment and other income sources to balance out any future fall.

- Long-term Considerations of Starting an Endowment - yes, WMF like most non-profit seek to exist in perpetuity. I don't think anyone would argue against it. As for limiting the financial spending and become prudent, accountable - those are long term demands of the community and any good benefactor.

- A Recommended Endowment Building Strategy - Seems like a healthy strategy. I had similar points.

- Immediacy - there is a quote about donors expecting immediate results and instant gratification from their donations. This belief is again predicated on the fact that donors get to see what their dollars bought - if this was red cross or MSF that would be easy, for wikipedia, they think they are keeping it online - which is misleading and untrue. The truth would be they might have paid for flow or AFT - how many would like to know the project they paid for ended up being disliked or worst, ending up in the bin? I would instead argue any donors would like his donation to live on in perpetuity - months, years, decades even after they are gone, a single dollar in an endowment would keep on paying over and over and over. Any donor would prefer that kind of impact over paying for "annual budget of WMF 2011" then forgotten next year.

- Sustaining phase - I disagree here about increasing the endowment to offset any budget growth. This entire line of thinking is wrong. You would have no control when the money comes in to the endowment, hence you can't choose to grow it 10 million to offset an increase of 5 million in the budget. There would of course be contingencies to plan for future growth but endowment can not and should not be treated as an easy go-to piggy-bank. The yields have to be set in stone and made independent. An alternative strategy is focusing on alternative revenue sources and annual fundraiser to fill the gaps in the budget, the entire point of having an endowment is to have a stable set income that remains at a constant. The alternative source like the annual fundraiser can be re-evaluated, increased/decreased, revised and be left at a variable. The two are totally different types of income that should be treated as such.

Specific recommendations-

- Initial target of $250 Million while the endowment is kept open-ended. Achievable in 10 years and then de-prioritised.

- Endowment staff, a sub-department under fundraising separate from annual fundraising staff.

- Oversight committee, along with investment managers run the fund independently.

- Endowment established as a separate trust, a legal entity that is independent.

- Board resolutions should be proposed to start this process off or present a strategy by a set date. (it is taking too long)

Thanks. Theo10011 (talk) 21:28, 2 December 2015 (UTC)

- this is very good. however, i would suggest the analogy to a university is a good one, or say the smithsonian institution; i do not see WMF as hybrid tech company, rather it has an non-profit educational mission enabled by software. the crowd sourcing is a means to an end. but the disagreement is more about how they spend the money on mission, than in the financial support infrastructure.

- i would suggest a target of 2-3 % is too low. historically, 5% is used; 50 year experience is 6%, and some argue for 4%. by eschewing market risk, you are taking on inflation risk. the cost of servers may be declining, but the cost of people and real estate is rising. Slowking4 (talk) 20:39, 23 December 2015 (UTC)

How should we select members of the Wikimedia Endowment Advisory board?

For some context here: We looking for advice about the size of the Advisory Board, how many people should be on it, what skills we should be looking for in the members, how they should be selected and how long the terms should be. Thanks! --Lgruwell-WMF (talk) 17:49, 21 January 2016 (UTC)

- Please keep it to a small group, say three or at most five. I'd think the main goal would be to oversee what the Tides Foundation is doing with investing the money and a secondary goal would be to oversee (perhaps that's too strong) the fund-raising part. But I assume the main oversight of the fundraising is going to be by the WMF Board. A financial background would be helpful and there probably should be somebody who has worked with an endowment before. Get Jimmy Wales - he certainly knows about Wikipedia and has some knowledge of finance. Smallbones (talk) 19:44, 26 January 2016 (UTC)

- I am thinking the same way about this, Smallbones. I think we would want Endowment advisory board members to 1) Help us raise the fund. Connect us to people who might be interested in making a gift to the endowment, host dinners with potential donors, etc. 2) Oversee the investment of the fund. 3) Make decisions about the future structure of the fund going forward (When and if we should spin it out of Tides into another type of structure). --Lgruwell-WMF (talk) 17:59, 27 January 2016 (UTC)

A few thoughts: From my perspective, endowment funds, because they are intended to ensure financial stability for an extended period, demand comparatively conservative, risk-averse investment strategies that are broadbased and not dependent on one or a small number of industries. I'd look for at least one person who has some experience overseeing an existing non-profit's endowment fund that is doing well, at least one or two experienced Wikimedians who have a sound financial background (I'm going to be bold and say Smallbones might well be a good candidate!), and would suggest giving little weight to people whose investment history has a focus on venture capital markets. Successful endowment funds tend to stay away from really unpredictable sectors like venture capital. Yes, there's always the chance of a big win; but there's also the chance of a big failure, and a significant hit on the endowment fund could have serious repercussions such as having endowment fund donations dry up. Risker (talk) 01:52, 1 February 2016 (UTC)

I would like to know what form of committee are we talking about here?

There are three "board committees" (Governance, Audit, HR) whose voting members are all on the WMF board. These are sub-committees of the Board [there are non-voting community members on the Audit committee however]. There are also "Community committees" that are empowered by the Board (FDC, Affcom, Language, Research) whose voting members are from the community [although the research and language committees have WMF staff on them they were added because of their volunteer role not their staff role; the FDC and Affcom both have non-voting board observers].

I assume that for the Endowment committee we are talking about a different kind of design - something that will have external appointments to it (like the WMF board itself) - but I just want to confirm that this proposed Endowment committee is not a Board Committee? If so, then:

- It should not have voting members who are also WMF Board members. IMO there should be one or two observers from the WMF Board (also the WMF CFO and chief of Fundraising?), but they should be separate things.

- Having direct appointments to this committee is perfectly sensible and obvious as far as I am concerned, for all the reasons that those kinds of positions are important to the Board itself. Selection of these people, however, needs to be made particularly carefully as it is not merely a matter of people who have financial-expertise but also have a demonstrably strong awareness of the values and ethical considerations of the Wikimedia movement. To that end, undertaking a consensus-building consultation and laying down some investment principles would be a necessary first action of the committee.

- There should also be some positions that are grounded in community-wide elections. This would be to ensure legitimacy and 'connection' to the volunteer base in general, and also is part of our principle of empowering the community to take positions of responsibility in the movement. So, I would suggest that such positions be nominated at the same time as the Board and FDC elections that we already run simultaneously.

Wittylama (talk) 13:48, 4 February 2016 (UTC)

- Thank you for your thoughtful comments, Risker and Wittylama. Let me answer the question about the form of the committee. The Wikimedia Endowment has been established as a Collective Action Fund at Tides Foundation as a permanent, income-generating fund to support the Wikimedia projects. Tides has over 40 years of experience administering funds for nonprofits and helping to launch such efforts. They often serve as fiscal sponsors for organizations when they are first starting out and will be providing administrative support to the Wikimedia Endowment. The endowment will be independent from WMF but an initial Advisory Board, nominated by the WMF and appointed by Tides, will make recommendations to Tides related to the endowment. We have the option in the future to transfer the endowment out of Tides to the WMF or to a new charitable entity. The endowment will continue to be a permanent, income-generating fund to support the Wikimedia projects under any entity. For now, we feel Tides is a great, cost effective place to start and we will look at other options when the endowment reaches critical mass. While the initial Advisory Board will be nominated by WMF's board, we have not determined yet how Endowment Advisory Board members will be nominated going forward, how many members to have, how long the term should be, etc. That will be determined in the Operating Agreement, which staff will draft and take to the WMF board for consideration in the coming months. --Lgruwell-WMF (talk) 17:45, 4 February 2016 (UTC)

- Re: "We have the option in the future to transfer the endowment out of Tides to the WMF", for that option to be exercised, would it require a vote by the majority of the advisory Board members, a majority of the members of the WMF board, a decision by the WMF CEO, or something else? And is there any restriction on dual advisory board / WMF board membership?

- What I am hoping to hear is that the WMF board and WMF top management are free to spend the interest from the endowment as they see fit, but that they have to jump through some serious hoops to spend the principal, and that it would be equally difficult to change the rules in order to make it easier to spend the principal. --Guy Macon (talk) 14:07, 8 March 2017 (UTC)

- (Sound of Crickets...) --Guy Macon (talk) 21:51, 10 March 2017 (UTC)

- (...Chirp...) --Guy Macon (talk) 19:20, 14 March 2017 (UTC)

- Thanks for the question Guy Macon. Our plan is to keep the endowment at Tides while we are in the "startup" phase of the endowment. We plan to put it into a new 501 c3 in a couple years. The provision to move the endowment to WMF is only an emergency escape clause in case we were receiving poor service from Tides. It is one we do not think we will ever have to use. Tides is a great partner. There are rules that regulate endowments and how much they can pay out, which we will follow. We are many years away from that though. While we are in this first 10-year endowment building phase, our focus is on growing the fund and will not be making grants until the $100 million goal is met. Thank you. --Lgruwell-WMF (talk) 03:54, 17 March 2017 (UTC)

- While good intentions and future plans are good things, my questions were about what the actual, legal limitations on the WMF are. May I please have answers to the specific questions I asked?

- Q: For the "We have the option in the future to transfer the endowment out of Tides to the WMF", option to be exercised, would it require a vote by the majority of the advisory Board members?

- A: Yes. The WMF board has already given us the direction to move it into a separate 501c3 once the endowment reaches $33 million. --Lgruwell-WMF (talk) 16:09, 29 March 2017 (UTC)

- Just to be clear, may I assume that the WMF cannot transfer it anywhere else without another vote by the WMF board? In particular, may I assume that the endowment cannot be dipped into to cover spending without another vote by the WMF board? --Guy Macon (talk) 20:28, 7 April 2017 (UTC)

- The Endowment cannot be dipped into for other spending with or without a vote of the board. There are rules covered under UPMIFA that regulate this. --Lgruwell-WMF (talk) 00:13, 13 April 2017 (UTC)

- Just to be clear, may I assume that the WMF cannot transfer it anywhere else without another vote by the WMF board? In particular, may I assume that the endowment cannot be dipped into to cover spending without another vote by the WMF board? --Guy Macon (talk) 20:28, 7 April 2017 (UTC)

- Q: For the "We have the option in the future to transfer the endowment out of Tides to the WMF", option to be exercised, would it require a decision by the WMF CEO? --Guy Macon (talk) 20:28, 7 April 2017 (UTC)

- A: WMF's Executive Director is supportive of moving it to a new 501c3 once it reaches $33 million. --Lgruwell-WMF (talk) 16:09, 29 March 2017 (UTC)

- That doesn't really answer the question I asked. Can the WMF's Executive Director unilaterally decide to move the funds? --Guy Macon (talk) 20:28, 7 April 2017 (UTC)

- No. --Lgruwell-WMF (talk) 00:13, 13 April 2017 (UTC)

- Q: Are there any restrictions on dual advisory board / WMF board membership?

- A: Yes, there can be some overlap, but if there is too much than you loose the legal protection you get by having this be an entity independent of WMF. --Lgruwell-WMF (talk) 16:09, 29 March 2017 (UTC)

- "There can be some overlap" and "if there is too much" sound like general principles, not specific restrictions. Are there any actual restrictions on dual advisory board / WMF board membership, and if so what are they? Please note that "we have not decided on exactly what the restrictions should be" or "the exact restrictions will be decided on a case-by-case basis by a WMF board vote" would be perfectly acceptable answers. -Guy Macon (talk) 20:28, 7 April 2017 (UTC)

- With all due respect, I am having trouble reconciling the above lack of answers (not even a "no, we will not disclose that information") with the WMF's claim that "The Wikimedia Foundation has a formal position that transparency is a core principle".[1] --Guy Macon (talk) 10:00, 26 March 2017 (UTC)

- Also see Requests for information#Wikimedia Endowment. --Guy Macon (talk) 10:47, 26 March 2017 (UTC)

- The endowment was set up to help protect funds for the movements future. To do this maintaining separation between the endowment and the WMF is required.

- I assume that such a transfer would be done if the WMF felt that they could hire staff to do a similar job for less in house. But would sort of end the "protection" of funds benefit of having it managed by an independent entity,

- Not sure what effects the WMF and the endowment sharing board members has on this protection from a legal perspective. Would be interested in hearing a legal opinion. Doc James (talk · contribs · email) 09:57, 27 March 2017 (UTC)

- Also see Requests for information#Wikimedia Endowment. --Guy Macon (talk) 10:47, 26 March 2017 (UTC)

- Note: this was answered on 16:09, 29 March 2017, 21 days after the question was first asked. (See the "Q:" and "A:" sections above). I did not notice the changes at the time. --Guy Macon (talk) 20:28, 7 April 2017 (UTC)

Questions about 501(c)

Forgive me if these are stupid questions; my expertise is in engineering, not finance.

Regarding the statement above "The WMF board has already given us the direction to move it into a separate 501c3 once the endowment reaches $33 million":

Will this be a 501(c)(3) organization or some other type? --Guy Macon (talk) 20:28, 7 April 2017 (UTC)

- Will be a 501(c) from my understanding. Same type of entity as the WMF. Doc James (talk · contribs · email) 22:04, 12 April 2017 (UTC)

- That's right. A separate 501c3. --Lgruwell-WMF (talk) 00:20, 13 April 2017 (UTC)

- Will be a 501(c) from my understanding. Same type of entity as the WMF. Doc James (talk · contribs · email) 22:04, 12 April 2017 (UTC)

Is there anything innate about being a 501(c) that prevent the scenario that I describe at WP:WIKIPEDIAHASCANCER (revenues drop, spending keeps increasing, the WMF drains the endowment to support continued spending increases)? Or would that be a function of how the 501(c) is structured? --Guy Macon (talk) 20:28, 7 April 2017 (UTC)

- Yes, there are several things that help prevent this. 1) We are establishing separate governance for the endowment. 2) The grant agreements that we sign when donors make a gift to the endowment often address this issue. 3) There are rules that regulate endowments covered under UPMIFA. --Lgruwell-WMF (talk) 00:20, 13 April 2017 (UTC)

In other words, could some future CEO or some future board drain the endowment to support continued spending? Could they be forced to do so if the WMF loses a major lawsuit and has to shell out hundreds of millions of dollars? --Guy Macon (talk) 20:28, 7 April 2017 (UTC)

- Having the endowment separate from WMF helps to prevent this lawsuit scenario you mention. --Lgruwell-WMF (talk) 00:20, 13 April 2017 (UTC)

- Interesting, and avoiding lawsuits in the first place is certainly desirable, but I am still waiting for answers to the specific questions I asked. Again I ask, could some future CEO or some future board drain the endowment to support continued spending? Could they be forced to do so if the WMF loses a major lawsuit and has to shell out hundreds of millions of dollars? --Guy Macon (talk) 17:43, 13 April 2017 (UTC)

- (...Sound of Crickets...)

- From Stonewalling:

- "Stonewalling is a refusal to communicate or cooperate [or] the use of deflection in a conversation in order to render a conversation to be pointless and insignificant. Tactics in stonewalling include giving sparse, vague responses, refusing to answer questions, or responding to questions with additional questions. In most cases, stonewalling is used to create a delay compared to putting the conversation off forever."

- --Guy Macon (talk) 20:53, 12 April 2017 (UTC)

┌─────────────────────────────────┘

It has been six days since I asked the above specific followup question ("could some future CEO or some future board drain the endowment to support continued spending? Could they be forced to do so if the WMF loses a major lawsuit and has to shell out hundreds of millions of dollars?"). Clearly the WMF has no interest in having any sort of dialog about this.

The following are the results of my own original research. I apologize in advance for the inevitable errors that will no doubt occur as an electrical engineer attempts to address complex legal questions, but the continued WMF stonewalling gives me no other choice.

Above, Lgruwell-WMF makes the following claims:[2]

- "We are establishing separate governance for the endowment. 2) The grant agreements that we sign when donors make a gift to the endowment often address this issue. 3) There are rules that regulate endowments covered under UPMIFA."

- "The Endowment cannot be dipped into for other spending with or without a vote of the board. There are rules covered under UPMIFA that regulate this."

- "The Uniform Prudent Management of Institutional Funds Act, or UPMIFA, is a complex law that holds sway in almost every state in the nation. It covers how charitable institutions are to administer donor-permanently-restricted gifts. This law only applies to permanently restricted gifts made by donors to charitable institutions. It does not apply to charitable trusts or donor advised funds. It also does not apply to endowment funds established by a charitable institution itself from previously unrestricted funds."

and

- "The first principle that the UPMIFA law recognizes is that there are institution-created endowment funds and permanently-restricted endowment funds created by donor gifts. If you look at the dictionary definition of 'endowment,' however, you would think that all endowment funds are the same -- a fund that is permanently restricted to provide ongoing support for the charity. But the UPMIFA law only applies to funds given to a charity by a donor who has specified that the funds be permanently restricted."

Also, http://www.nonprofitlawblog.com/upmifa-one-year-later/ says

- "Under UPMIFA, an endowment fund is generally defined as a fund not wholly expendable on a current basis under the terms of a gift instrument. An endowment fund does not include either a fund that the institution's board itself designates as an endowment ("quasi-endowment"), or a program-related (exempt function) asset. A gift instrument may be any written record from the donor or from the institution so long as both parties were, or should have been, aware of its terms."

When I have donated to the WMF in the past, I never signed anything that would imply that my gifts to the WMF were restricted in any way, and thus no gift instrument exists regarding my donations. If any such permanent restriction regarding the endowment actually exists, I would like to see a link to the actual legal documents such as the "grant agreements that we sign when donors make a gift to the endowment" that Lgruwell-WMF references above.

- Per WMF's Gift Policy, we only accept restricted gifts over USD $100,000. Nearly all of our gifts into the endowment include grant agreements (gift instruments) that restrict the funds for the endowment. --Lgruwell-WMF (talk) 20:19, 27 April 2017 (UTC)

Until I get a clear answer to the actual question asked, I have no choice but to assume that absolutely nothing prevents the scenario that I describe at WP:WIKIPEDIAHASCANCER (revenues drop, spending keeps increasing, the WMF drains the endowment to support continued spending increases or is forced to drain the endowment to pay the judgement after after losing a court case).

I am deeply disappointed that the WMF refuses to engage the community in any sort of open discussion regarding this issue.

(...Sound of Crickets...) --Guy Macon (talk) 17:37, 18 April 2017 (UTC)

- SUCCESS!!! A member of the WMF board has answered the specific questions I asked above.[3] --Guy Macon (talk) 02:14, 19 April 2017 (UTC)

- And another.[4] Straight answers to the specific questions asked, both of them. :) --Guy Macon (talk) 08:24, 19 April 2017 (UTC)

Investment mix

On sustainable investment, two months after the ESG assessment, which was very much appreciated and showed room for improvement, I just want to leave here a link: http://www.etf.com/channels/socially-responsible . Availability of ESG information is rapidly growing and ESG ETFs are also growing quickly in size (the linked list shows the biggest grew by 50 M$ in one month).

As an aside, I'm not sure why as much as 68 % of the endowment needs to be invested on USA assets, I'd expect something more global. Is this investment mix expected to be countercyclical to donation trends? I guess this decision was affected by some practical considerations such as fees and liquidity or trading locations, although the selected benchmarks seem to narrow down the selection a lot (are they basically just VTI and VEA?). --Nemo 11:31, 19 December 2017 (UTC)

- I'm not sure it's a good idea, but fossil companies are now issues "SDG-linked" bonds for the SRI world, saying they'll pay a penalty if certain sustainability targets are not met.[5]

- This just to note that the universe of sustainable it rapidly increasing. See also what ECB and EIB people had to say. Nemo 12:02, 6 September 2019 (UTC)

Benchmarking

@Lgruwell-WMF: Lisa, the "Benchmark" section is about asset allocation, not benchmarks. Can we please benchmark the Endowment and CFO investments against [6] and [7]?

Also, why was real estate considered desirable at the level stated in that section? James Salsman (talk) 17:32, 22 January 2018 (UTC)

- The investments in each asset class have a benchmark, which is what is named in the table.--Lgruwell-WMF (talk) 23:56, 26 January 2018 (UTC)

- Please see [8]. 71.218.1.84 05:10, 5 March 2018 (UTC)

Update needed.

Where are the January, 17, 2018 Minutes? --Guy Macon (talk) 15:38, 6 August 2018 (UTC)

- Updated! MBrent (WMF) (talk) 15:39, 14 August 2018 (UTC)

Endowment financial statement

continuing a conversation from twitter. User:Katherine (WMF); User:Peteforsyth; User:Megs

it's great that pro forma financial statements from June 2018 were put out in November.[9] i would like to see more detail about endowment, including decisions made elsewhere about accumulation, size goal, investment allocation, and investment results. for me the financial statement is a good place to summarize and communicate the plan and consensus about endowment.

i would like to see the financial statements show the resource allocation to meet goals in the strategic plan.

this is a great opportunity to proactively communicate about resources, and educate the community about non-profit governance. Slowking4 (talk) 15:40, 26 January 2019 (UTC)

- Hi Slowking4, this is definitely something we can do. Your comments and thinking on this page were very helpful when we were getting ready to launch the endowment. Maybe we could set up a time to talk so I can better understand what you are thinking? --Lgruwell-WMF (talk) 00:12, 7 February 2019 (UTC)

- Thanks Slowking4, I added my comment from Twitter above, in the section #What should be the strategic purpose of a Wikimedia Endowment?. Financial statements are important, and so are clearly and formally articulated principles around how money is or isn't to be spent. -Pete Forsyth (talk) 21:01, 26 January 2019 (UTC)

Investment update

Lgruwell-WMF, may we please see the investment update presentation? The most recent running total here says, "as of July 1, 2019, $43 million has been raised," of a $100 million goal. What is the current amount? How is it currently invested? Is $100 million still the current goal? What will happen to bequests after the goal is reached? EllenCT (talk) 15:46, 9 February 2020 (UTC)

- @EllenCT: User:KThaney (WMF) posted an update to the amount yesterday. --Yair rand (talk) 21:01, 12 February 2020 (UTC)

- @EllenCT: As Yair rand mentioned, the latest amount has now been posted. It is currently invested according to the Investment policy described on the page. $100 million is the initial goal that was set at the creation of the Endowment. The Endowment is expected to grow (from bequests and other sources) past the $100 million mark, which serves as a milestone for when we are planning to start spending the interest on activities that advance the movement's mission. HTH, Guillaume (WMF) (talk) 22:21, 14 February 2020 (UTC)

Moving to a separate 501c3 organization

Three years ago, the WMF Chief Advancement Officer mentioned that the intention was to move the Endowment to a new separate 501c3 nonprofit organization "once it reaches $33 million" / "in a couple years". The July meeting minutes mentioned that the WMEAB was "[h]olding off on discussions about forming a separate 501c3 until the Wikimedia Foundation completes the hire of a General Counsel", and then the new General Counsel was hired in October, followed by another WMAEB meeting in January, this time with the new General Counsel in attendance. Is the new creation of the new organization imminent? Any details on how the new organization is going to work? --Yair rand (talk) 21:01, 12 February 2020 (UTC)

- @Yair rand: The possibility of creating a separate organization was discussed at the January meeting but no decision has been made yet. Guillaume (WMF) (talk) 22:15, 14 February 2020 (UTC)

- Thanks for the update. Are there any preparatory documents on the topic which you may be able to share already? I suppose that an assessment of the impact on operating costs would be one of the first steps, possibly preceded by a discussion on what are the main priorities or factors to consider.

- For instance, the page currently claims "Tides Foundation which screens all of their investment options for environmental, social, and governance (ESG) factors", which is quite a cryptic statement considering that above "Typical investments will include Exchange Traded Funds" but at any rate assumes some kind of proactivity. It's not clear what cost is charged for this supposed service. In general, the vehicle of the endowment will presumably also depend on what kind of investments it's supposed to execute. Nemo 21:52, 16 February 2020 (UTC)

Morningstar isn't including accurate GHG emissions in their ESG ratings

I heard directly from Morningstar and Sustainalytics, that their ESG ratings do not include the "Scope 3" carbon footprint (see e.g. pp. 87-93) of the World Resources Institute, World Business Council for Sustainable Development, and Carbon Trust's Greenhouse Gas Protocol Corporate Value Chain Accounting and Reporting Standard. So for example much of the 25% reduction in carbon emissions from work-from-home policies may not be accurately credited to the companies implementing them. EllenCT (talk) 17:27, 11 March 2020 (UTC)

- We are happy to use another publicly available rating system. Unfortunately, I do not know of a better one. Open to suggestions here. --Lgruwell-WMF (talk) 21:43, 16 October 2020 (UTC)

- Hi Lgruwell-WMF, I recall talking to you about Arabesque, which apparently offer such services, just to mention one example. The aspect I dislike the most about Morningstar is that they accept a 'best-in-class' approach, meaning that it is totally fine to invest e.g. in an oil corporation or a weapons manufacturer, as long as you limit yourself to the more sustainable oil corporations among all of the oil corporations. For these reasons, I think that it is high time to discuss and adopt an investment strategy for the Wikimedia Endowment that lays out our principles in this regard and where we want to go with it. Just recently, the University of Cambridge made headlines when it decided to divest its endowment from fossil fuels by 2030. --Gnom (talk) 16:52, 17 October 2020 (UTC)

Hosting digital collections for the foreseeable future

One of the reasons why I and some others supported creating an endowment was that it would make us a more attractive partner for the cultural sector. There are lots of Galleries, Libraries, Archives and Museums that have digitised their collections or are contemplating such an investment, and a question in such investments is the possibility of placing a copy with a custodian who has some surety of being a host for the foreseeable future. Now that we have the endowment, or when it is large enough, it would be very good news for the cultural sector if the Foundation could announce that its endowment was now sufficiently strong that it could maintain Wikimedia Commons and WikiSource indefinitely. This may tempt more institutions to upload material to those sites. WereSpielChequers (talk) 09:52, 3 March 2021 (UTC)

- Great point! --AParker (WMF) (talk) 18:22, 4 March 2021 (UTC)

Questions (from Wikimedia Enterprise discussion)

Liam suggested in a discussion on Talk:Wikimedia_Enterprise where the Tides Foundation and the Endowment popped up a couple of times that I post Endowment-related questions here.

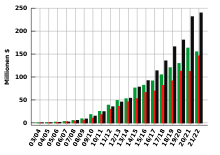

First, for context, here is the current status of the WMF fundraising figures, taken from here:

| Year | Source | Revenue | Expenses | Asset rise | Total assets |

|---|---|---|---|---|---|

| 2019/2020 | $ 129,234,327 | $ 112,489,397 | $ 14,674,300 | $ 180,315,725 | |

| 2018/2019 | $ 120,067,266 | $ 91,414,010 | $ 30,691,855 | $ 165,641,425 | |

| 2017/2018 | $ 104,505,783 | $ 81,442,265 | $ 21,619,373 | $ 134,949,570 | |

| 2016/2017 | $ 91,242,418 | $ 69,136,758 | $ 21,547,402 | $ 113,330,197 | |

| 2015/2016 | $ 81,862,724 | $ 65,947,465 | $ 13,962,497 | $ 91,782,795 | |

| 2014/2015 | $ 75,797,223 | $ 52,596,782 | $ 24,345,277 | $ 77,820,298 | |

| 2013/2014 | $ 52,465,287 | $ 45,900,745 | $ 8,285,897 | $ 53,475,021 | |

| 2012/2013 | $ 48,635,408 | $ 35,704,796 | $ 10,260,066 | $ 45,189,124 | |

| 2011/2012 | $ 38,479,665 | $ 29,260,652 | $ 10,736,914 | $ 34,929,058 | |

| 2010/2011 | $ 24,785,092 | $ 17,889,794 | $ 9,649,413 | $ 24,192,144 | |

| 2009/2010 | $ 17,979,312 | $ 10,266,793 | $ 6,310,964 | $ 14,542,731 | |

| 2008/2009 | $ 8,658,006 | $ 5,617,236 | $ 3,053,599 | $ 8,231,767 | |

| 2007/2008 | $ 5,032,981 | $ 3,540,724 | $ 3,519,886 | $ 5,178,168 | |

| 2006/2007 | $ 2,734,909 | $ 2,077,843 | $ 654,066 | $ 1,658,282 | |

| 2005/2006 | $ 1,508,039 | $ 791,907 | $ 736,132 | $ 1,004,216 | |

| 2004/2005 | $ 379,088 | $ 177,670 | $ 211,418 | $ 268,084 | |

| 2003/2004 | $ 80,129 | $ 23,463 | $ 56,666 | $ 56,666 |

The financial statements also mention that During the year ended June 30, 2016, the Foundation entered into an agreement with the Tides Foundation to establish the Wikimedia Endowment as a Collective Action Fund to act as a permanent safekeeping fund to generate income to ensure a base level of support for the Wikimedia projects in perpetuity. The Endowment is independent from the Foundation. They go on to say that the Foundation [has] provided irrevocable grants ... to the Tides Foundation for the purpose of the Wikimedia Endowment. These amounts are recorded in awards and grants expense. (Source: Financial Statements 2019/2020, p. 14) So as I understand it some of the expenses in the above table are actually profits put into the endowment.

I and I am sure many others would be interested in answers to the following questions:

1. Does the Wikimedia Endowment publish something equivalent to a Form 990? Where can people see what money entered and left the endowment? --Andreas JN466 20:32, 12 April 2021 (UTC)

- No grants will be made from the Endowment until its total revenue surpasses $100 million. Updates on funds raised are posted to this page. We are in the process of transitioning the Endowment to a new US 501c3 charity, after which it will begin making grants and will publish its own Form 990. --AParker (WMF) (talk) 12:50, 20 April 2021 (UTC)

2. Originally it was envisaged that it would take ten years to bring the Endowment to $100 million. It was reported in January of this year to stand at $90 million, and was said to be approaching $100 million last month. So the WMF took $50 million more from the donating public than it would have needed to in order to fulfil its publicised plan. Who took that decision? --Andreas JN466 20:32, 12 April 2021 (UTC)

- When the Endowment was launched in 2016, it was not possible to predict how donors would respond to solicitations for the Endowment or what funds would be raised for it through gifts in wills. We set a goal of securing $100 million by 2026 and have been learning since then. The Endowment has grown faster than expected thanks to the support of generous donors who have responded to our solicitations for Endowment gifts as well as direct contributions from the Wikimedia Foundation. --CVirtue (WMF) (talk) 13:43, 20 April 2021 (UTC)

- Thank you very much for your answers to date, CVirtue (WMF) and AParker (WMF). There is one element of this question that has remained unanswered: Who took (takes) the decision to keep fundraising – to continue showing fundraising banners on Wikipedia – well past the point when publicised fundraising targets have been exceeded? Please correct me if I am wrong, but I can remember only one occasion where the year-end, English Wikipedia US and UK fundraiser was stopped early, and I recall that decision was preceded by press coverage drawing attention to the fact that the WMF was continuing to display banners well past the point when it had reached its publicised goal. Who decides when the fundraising banners stop and the donations tap/faucet is closed? Who decides to keep it open even when publicised targets have already been exceeded? Is it a board decision, an ED decision, or an Advancement decision? Andreas JN466 15:17, 20 April 2021 (UTC)

- Hi Andreas,

- We’ve recently posted a similar response in the financial reports FAQ which describes the decision making from WMF leadership and board:

- The Wikimedia Foundation’s goal is to ensure we have an appropriate amount of available operating cash. As a non-profit it is prudent to ensure that we have sufficient cash funds in the event that unforeseen opportunities arise, or an external or internal event limits our ability to raise funds. This is important for stability and the overall financial health of the organization and in particular, with the COVID-19 pandemic which brings a significant amount of volatility and uncertainty for a majority of businesses, including non-profit organizations.

- There is no general guideline on what amount of cash availability is appropriate for a non-profit; different non-profits maintain different levels of available operating cash depending on their age, maturity, and mission. The cash and investment balance of the Wikimedia Foundation on 30 June 2020 represents about 19 months of operating funds, based on our Fiscal Year 2020-2021 Annual Plan, which has increased slightly from fiscal years 2018-2019 and 2017-2018; we believe the amount is appropriate for a growing non-profit of our size and age, especially during the uncertainty of the COVID-19 environment. Our goal is to have at least one year of operating funds so that we are able to sufficiently support our operating expenses if we are unable to raise the required budget through our usual fundraising activity. Additionally, we want to have the ability to use our surplus to fund specific and non-recurring investment opportunities.

- The fundraising team has also canceled campaigns and ended them early many times over the years when we were in the fortunate situation to be on track to reach our targets. We don’t always publicize or make announcements about these campaign cancelations but I’d be happy to share a few recent examples: In March-June of 2020, the fundraising team canceled several campaigns with the COVID pandemic. We have also been working with Wikimedia Mexico on the fundraising campaign that is live right now. This campaign was originally scheduled for May 2021 but the fundraising team moved the dates earlier and shortened the campaign to run for half of the scheduled time so that the community could run the Wikilovesmexico campaign during their preferred time frame in May. In 2020, we also ran several campaigns at a significantly reduced volume. Hope these examples are helpful! --Ppena (WMF) (talk) 17:53, 23 April 2021 (UTC)

- Hi Ppena (WMF), thank you very much, it is good to hear from you. When you say in the FAQ that "The cash and investment balance of the Wikimedia Foundation on 30 June 2020 represents about 19 months of operating funds", isn't it true that this disregards the over $90 million in the Wikimedia Endowment, which are also investments whose sole beneficiary is the Wikimedia Foundation, as well as another $9 million in the Tides Advocacy fund (see below)? The cash and investment balance of the WMF was about $170m at the end of June 2020. Planned total expenses for the 2020/2021 fiscal year are $108m. Hence, if the $100 million from the Endowment and Tides Advocacy fund were included (the money held in the Endowment does not appear to be mentioned at all in the FAQ), this would come to exactly 30 months of operating funds, or 2.5 years ($270m/$108m = 2.5). I know the Endowment and the WMF are legally separate, but don't you agree that mentioning the Endowment in the FAQ would be a more transparent reflection of the funds the Foundation has been able to accumulate? Regards, --Andreas JN466 18:32, 23 April 2021 (UTC)

- Thank you very much for your answers to date, CVirtue (WMF) and AParker (WMF). There is one element of this question that has remained unanswered: Who took (takes) the decision to keep fundraising – to continue showing fundraising banners on Wikipedia – well past the point when publicised fundraising targets have been exceeded? Please correct me if I am wrong, but I can remember only one occasion where the year-end, English Wikipedia US and UK fundraiser was stopped early, and I recall that decision was preceded by press coverage drawing attention to the fact that the WMF was continuing to display banners well past the point when it had reached its publicised goal. Who decides when the fundraising banners stop and the donations tap/faucet is closed? Who decides to keep it open even when publicised targets have already been exceeded? Is it a board decision, an ED decision, or an Advancement decision? Andreas JN466 15:17, 20 April 2021 (UTC)

- When the Endowment was launched in 2016, it was not possible to predict how donors would respond to solicitations for the Endowment or what funds would be raised for it through gifts in wills. We set a goal of securing $100 million by 2026 and have been learning since then. The Endowment has grown faster than expected thanks to the support of generous donors who have responded to our solicitations for Endowment gifts as well as direct contributions from the Wikimedia Foundation. --CVirtue (WMF) (talk) 13:43, 20 April 2021 (UTC)

- Hi Andreas To clarify, the $9M transferred to Tides Advocacy is not all for the Knowledge Equity Fund. $4,223,994 of the Tides Advocacy Fund will be distributed to the Annual Plan Grant affiliates this fiscal year, and you can see the details of their programs in the link above. The remaining funds are dedicated to the Knowledge Equity Fund as we shared in December. However, due to the pandemic and other operating priorities, we have been delayed in our original timeline to share more detail about the Knowledge Equity Fund. We will be able to share more information in May about the Equity Fund, its structure and eligibility for the Fund, and we will also have materials on Meta with more detail.KEchavarriqueen (WMF) (talk) 18:07, 28 April 2021 (UTC)

- I have one additional note here. The purpose of the Wikimedia Endowment is to support the Wikimedia projects. The Wikimedia Foundation will not be the sole beneficiary, and so it is not accurate to consider the Endowment’s assets as part of the Foundation’s assets. MeganHernandez (WMF) (talk) 19:01, 28 April 2021 (UTC)

- MeganHernandez (WMF), it says overleaf, The funds may be transferred from Tides either to the Wikimedia Foundation or to other charitable organisations selected by the Wikimedia Foundation to further the Wikimedia mission. How is that different from, say, having money in a bank? The level of control you have appears to be the same. --Andreas JN466 21:12, 28 April 2021 (UTC)

- I have one additional note here. The purpose of the Wikimedia Endowment is to support the Wikimedia projects. The Wikimedia Foundation will not be the sole beneficiary, and so it is not accurate to consider the Endowment’s assets as part of the Foundation’s assets. MeganHernandez (WMF) (talk) 19:01, 28 April 2021 (UTC)

3. Could you briefly confirm that the money held in the Endowment is not included in the net assets of the WMF's financial statements, but that moneys paid into the Endowment instead show up as expenses ("awards and grants") in the audited financial statements? --Andreas JN466 20:32, 12 April 2021 (UTC)

- The money held in the Endowment is not included in the net assets of the Wikimedia Foundation, as those funds are held by the Tides Foundation. Donations to the Endowment that are received by the Wikimedia Foundation as a pass through are redirected and sent to the Tides Foundation. Therefore, they are not reflected on the Wikimedia Foundation's financials as revenue or net assets. When the Wikimedia Foundation makes special grants to the Endowment Fund, those are reflected as Awards and Grants Expenses on the Wikimedia Foundation's Annual Independent Auditors' Report. --CVirtue (WMF) (talk) 13:43, 20 April 2021 (UTC)

- Thank you, CVirtue (WMF). Could you confirm the amount of money the Wikimedia Foundation itself has paid into the Endowment since it was set up in 2016? I mean here any and all payments to the Endowment that have been, or will be, reflected as "Awards and Grants" expenses in the Wikimedia Foundation's audited financial statements. Pinging JBrungs (WMF) as well. --Andreas JN466 16:19, 21 April 2021 (UTC)

- The Wikimedia Foundation has contributed a total of $20 million in direct grants to the Endowment since its inception until now.--AParker (WMF) (talk) 15:32, 27 April 2021 (UTC)

- Thanks, AParker (WMF), but that can't be right. Page 14 of the 2019/2020 audited accounts stated that $25 million had been paid into the endowment, $5 million p.a. over five years. The amount might have increased since then but not decreased. --Andreas JN466 05:29, 28 April 2021 (UTC)

- Thank you for following up on this point, as my prior answer was mistaken. The correct number is $25 million, as stated in the audited financial statements you referenced. --AParker (WMF) (talk) 13:42, 29 April 2021 (UTC)

- Thanks, AParker (WMF), but that can't be right. Page 14 of the 2019/2020 audited accounts stated that $25 million had been paid into the endowment, $5 million p.a. over five years. The amount might have increased since then but not decreased. --Andreas JN466 05:29, 28 April 2021 (UTC)

- The Wikimedia Foundation has contributed a total of $20 million in direct grants to the Endowment since its inception until now.--AParker (WMF) (talk) 15:32, 27 April 2021 (UTC)

- Thank you, CVirtue (WMF). Could you confirm the amount of money the Wikimedia Foundation itself has paid into the Endowment since it was set up in 2016? I mean here any and all payments to the Endowment that have been, or will be, reflected as "Awards and Grants" expenses in the Wikimedia Foundation's audited financial statements. Pinging JBrungs (WMF) as well. --Andreas JN466 16:19, 21 April 2021 (UTC)

- The money held in the Endowment is not included in the net assets of the Wikimedia Foundation, as those funds are held by the Tides Foundation. Donations to the Endowment that are received by the Wikimedia Foundation as a pass through are redirected and sent to the Tides Foundation. Therefore, they are not reflected on the Wikimedia Foundation's financials as revenue or net assets. When the Wikimedia Foundation makes special grants to the Endowment Fund, those are reflected as Awards and Grants Expenses on the Wikimedia Foundation's Annual Independent Auditors' Report. --CVirtue (WMF) (talk) 13:43, 20 April 2021 (UTC)

4. The endowment was set up with the Tides Foundation, which is known for handling "dark money". Should donors be concerned about this? If not, why not? --Andreas JN466 20:32, 12 April 2021 (UTC)

- When the Endowment was created, we chose Tides as our partner because of their 40-year track record of holding and managing charitable funds for nonprofit organizations. They have the highest possible score for finance and accountability from Charity Navigator, an independent organization that rates charities, and our relationship with Tides is actively managed by the Endowment’s Advisory Board. As we approach the $100 million funding milestone, we are in the process of establishing the Endowment as a separate 501c3. Read more about this in the Wikimedia-l post. --AParker (WMF) (talk) 12:50, 20 April 2021 (UTC)

5. I understand from Liam that the Endowment will soon be moved to "a stand-alone 501(c)(3) public charity to serve as the future corporate home for the Wikimedia Endowment". Does this mean that all the funds presently located with the Tides Foundation, down to the last cent, will be moved to this new charity? --Andreas JN466 20:32, 12 April 2021 (UTC)

- Yes. We are in the process of establishing a new home for the endowment in a stand-alone 501(c)(3) public charity. We will move the endowment in its entirety to this new entity once the new charity receives its IRS 501(c)(3) determination letter.--CVirtue (WMF) (talk) 13:43, 20 April 2021 (UTC)

6. What rules will the new charity put in place to govern the use of the Endowment? Will they be different from the present rules, and if so, how? (Please also note Guy Macon's question below.) --Andreas JN466 20:32, 12 April 2021 (UTC)

- I have just posted an answer to a question below, asked by user:Guy Macon in the thread below question 9, which I believe addresses this same point. --AParker (WMF) (talk) 13:21, 20 April 2021 (UTC)

7. The Endowment dates back to the time of the WMF's Knowledge Engine project, which might have become very costly had it been pursued. Was it ever envisaged that the Endowment might have played a role in financing this project? --Andreas JN466 20:32, 12 April 2021 (UTC)

- The purpose of the Endowment is to act as a permanent safekeeping fund to generate income to support the operations and activities of the Wikimedia projects in perpetuity. It had no connection to the Knowledge Engine project. --AParker (WMF) (talk) 13:11, 20 April 2021 (UTC)

8. Why is the fact that you have been trying (and succeeding) to build a $100 endowment in half the originally budgeted time not more prominent in fundraising banners shown to readers? Most small donors give because they see banners, widely perceived as alarming, telling them that money is needed for Wikipedia to "keep thriving", "to stay online", to "protect its independence". They are not told that the Foundation supporting Wikipedia has net assets most recently reported to stand at $180m, along with close to $100m in an Endowment. --Andreas JN466 20:32, 12 April 2021 (UTC)

9. How much money does the WMF actually have right now, expressed as a best estimate of net assets plus Endowment? In the first two quarters of the current July 2020–June 2021 financial year, it has reportedly already taken $124m (of a planned $125m, revised upwards from $108m) for the Foundation, and has taken $17.5 million for the Endowment, thus already exceeding its $5 million year goal by $12.5 million in the first two quarters alone. --Andreas JN466 20:32, 12 April 2021 (UTC)

I would be very grateful for answers to the above. Many thanks for your help in advance. Regards, --Andreas JN466 20:32, 12 April 2021 (UTC)

- Dear Andreas,

- Thank you very much for your questions, we will get back to you as soon as possible, here and on talk:Fundraising. --JBrungs (WMF) (talk) 09:40, 13 April 2021 (UTC)

I would ask the following question: Is it possible for the foundation to withdraw from the endowment principle to meet future budget shortfalls? (This would include moving the endowment from Tides to someplace else -- would the rules change?) If the foundation can touch the principle, who needs to sign off their approval in order to make that happen? In the interest of transparency, I would really like to see a link to a legally binding document or contract that specifies the answer to this question. --Guy Macon (talk) 15:19, 13 April 2021 (UTC)

- Guy, I understand the Endowment is about to move away from Tides to a new charity anyway, which is something your question touches on. For the avoidance of doubt, I have, with this edit, added a couple of questions about that move as well (now nos. 5 and 6). --Andreas JN466 19:27, 13 April 2021 (UTC)

- Imagine the following worst case scenario. A future board gets corrupted. A majority are secret Scientologists or perhaps just someone wanting to get rich even if it destroys Wikipedia. They kick out Jimbo and all the other board members who oppose them. They replace the CEO and key management members. The community goes apeshit,,a bunch of people resign, and it's in every paper but they don't care. They can grab all future donations. They can drain all bank accounts. They can sell all assets. My question is this: can they drain the endowment dry? Is the endowment principle something that neither the board or the CEO can touch, or is it just another bank account with a fancy name and maybe a few extra steps needed to make a withdrawal? --Guy Macon (talk) 19:53, 13 April 2021 (UTC)

- Because the purpose of the Wikimedia Endowment is to ensure the long-term future of the Wikimedia projects, investment and spending decisions have been and will continue to be made with the goal of preserving the fund’s principal. Once the fund reaches its initial $100 million milestone, the Endowment’s Board will make recommendations on expenditures. These will follow the guidelines of the Uniform Prudent Management of Institutional Funds Act (UPMIFA) and other regulations on prudent spending for endowments. --AParker (WMF) (talk) 13:11, 20 April 2021 (UTC)

- That is good news indeed. From the article: "...requirement that their investing and spending will be at a rate that will preserve the purchasing power of the principal over the long term." This is exactly what I have been advocating. If you or anyone else finds out that the foundation has entered into a legally binding obligation to follow the UPMIFA as opposed to a promise to follow the UPMIFA some time in the future, please ping me so I can update my essay that calls for doing that to instead say that it has been accomplished. — The preceding unsigned comment was added by Guy Macon (talk) 14:44, 20 April 2021 (UTC)

- Because the purpose of the Wikimedia Endowment is to ensure the long-term future of the Wikimedia projects, investment and spending decisions have been and will continue to be made with the goal of preserving the fund’s principal. Once the fund reaches its initial $100 million milestone, the Endowment’s Board will make recommendations on expenditures. These will follow the guidelines of the Uniform Prudent Management of Institutional Funds Act (UPMIFA) and other regulations on prudent spending for endowments. --AParker (WMF) (talk) 13:11, 20 April 2021 (UTC)

- Imagine the following worst case scenario. A future board gets corrupted. A majority are secret Scientologists or perhaps just someone wanting to get rich even if it destroys Wikipedia. They kick out Jimbo and all the other board members who oppose them. They replace the CEO and key management members. The community goes apeshit,,a bunch of people resign, and it's in every paper but they don't care. They can grab all future donations. They can drain all bank accounts. They can sell all assets. My question is this: can they drain the endowment dry? Is the endowment principle something that neither the board or the CEO can touch, or is it just another bank account with a fancy name and maybe a few extra steps needed to make a withdrawal? --Guy Macon (talk) 19:53, 13 April 2021 (UTC)