Q4 2020 Finishes Record-Setting Year for Games Investments

Q4 2020 DDM Games Investment Review Report Available

Q4 2020 DDM Games Investment Review Report Available

By the DDM Data & Research Team

Wow. What a year.

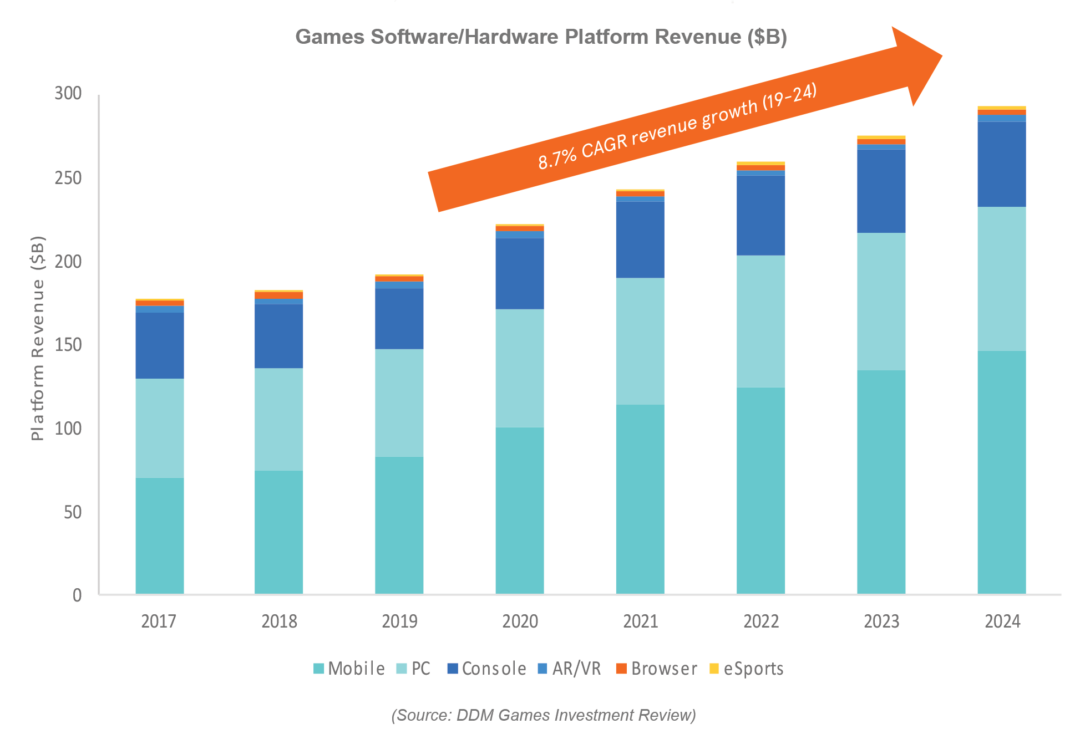

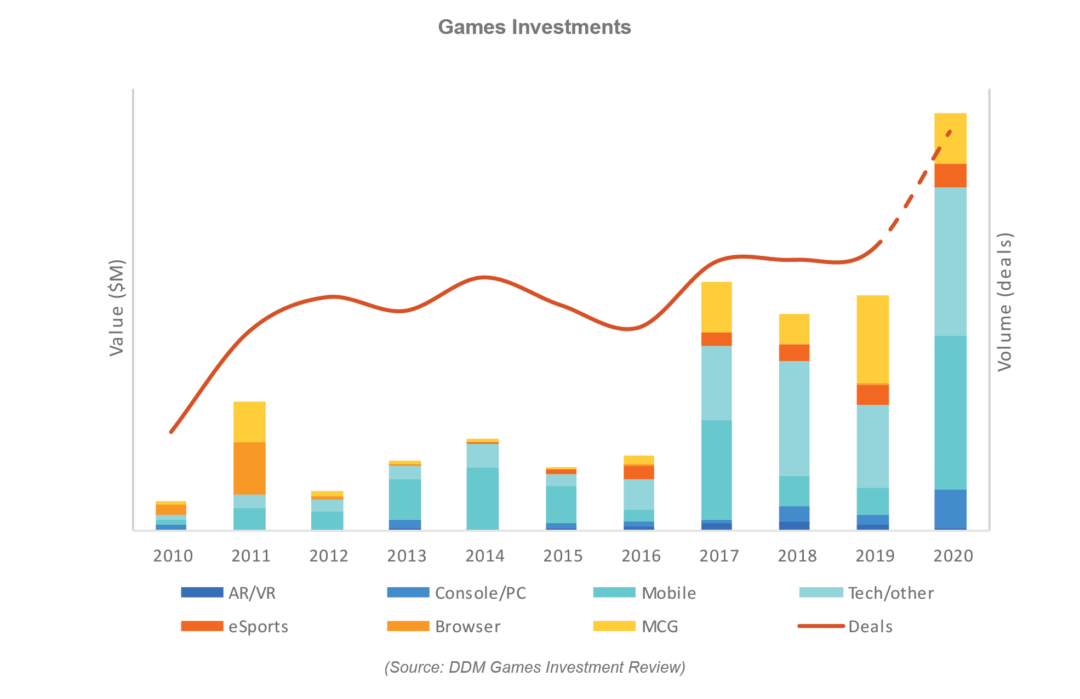

By the end of Q3, we already declared 2020 to be a record-setting year for investments. We recorded $9.9 billion in investments by the end of Q3, which exceeded the highest full year on record, 2017’s nearly $8.0 billion. The total through 2020 stands at an eye-popping $13.2 billion and over 600 deals—the highest value and active year to date! Due to record monthly corporate revenues based on an increase in player engagement and gaming due to the pandemic, in Q2, we increased our 2019-2024 CAGR for industry revenues by +11.6% to 7.7% for the first half of the year. On the strength of 2020 revenues and the continuation of lockdowns, we now revise our forecast a second time and estimate industry revenues with software and hardware will reach over $243 billion in 2021. Our latest 2019-2024 CAGR is 8.7%, an increase of +14% over our previous revised forecast.

Investments

And now that Q4 has concluded, let us repeat: Wow. What a year!

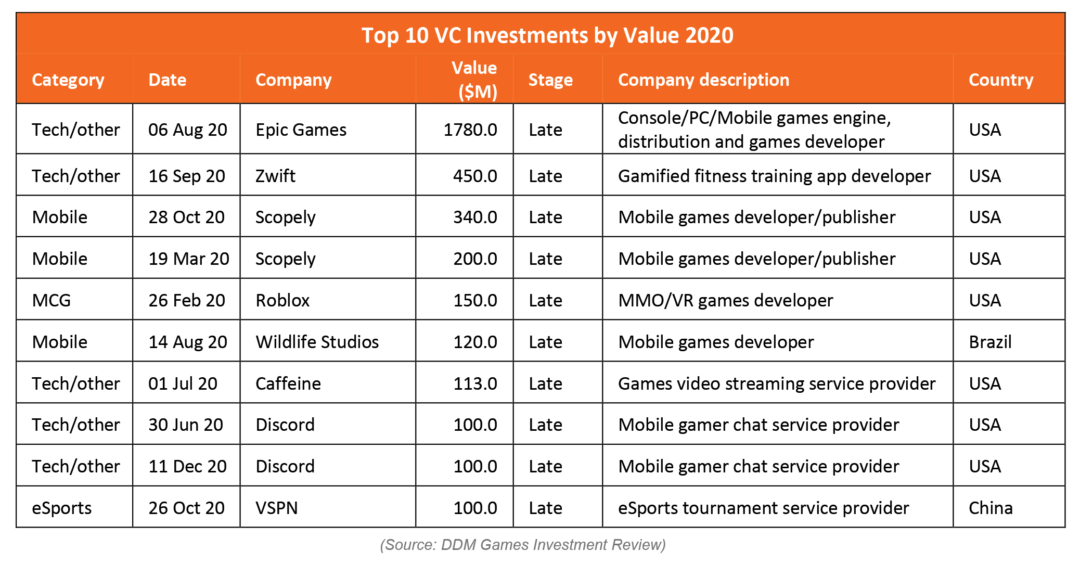

The $13.2 billion valuation of 2020’s investments was a +77% increase over 2019! At over 400 investments, the volume was a +42% increase YOY and another record. No other year has broken double-digit billions in value nor more than 300 in volume. Mobile and Tech/other transactions were the highest segments, each over 35% of the annual value. The next highest segments were MCG (Mass Community Games, which is our renamed MMO/MOBA/battle royale category) and Console/PC.

IPO and Post IPO raises were over 60% of the investment values in 2020, with venture capital funding nearly 39% of the funding and over 75% of the volume. The number of Seed raises in 2020 was over 1.6x the number in 2019 at 151 transactions with a slight +4% increase in the median value of Seed investments. Series A raises also increased +13% in volume but decreased in median value ‑32% YOY.

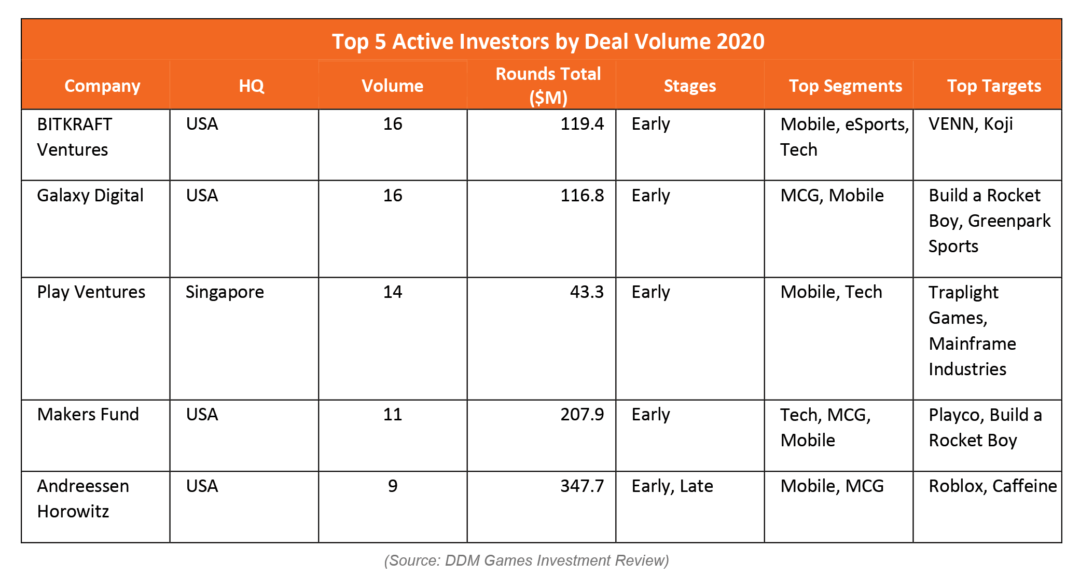

Our overall top 5 active investors for 2020 did not change significantly from our Q3 focus. The following chart shows the firms who stood out for the number of investments, excluding M&A deals.

We list the most active firms by deal volume and the total value of the disclosed investments in which they participated. Further, our investment tracking focuses on deals that involve the West, which means that Tencent barely missed the Top 5 list below as many of their 2020 investments were within China. As always, since announcements do not typically list the contribution breakdown by firm, we do not include a breakdown of how much is invested by each firm.

In 2020, several new gaming funds were announced or reinjected with funding, including:

- Andreessen Horowitz – $1.3 billion for consumer, enterprise and financial services technologies

- Griffin Gaming Partners – $235 million for gaming and associated tech

- BITKRAFT Ventures – $165 million for gaming, esports and interactive media

- March Gaming – $60 million for Seed and Series A games investments

- VGames – $30 million for early-stage game companies in Israel and Eastern Europe

- Lumikai – up to 20 early-stage deals for gaming companies in India

Additionally, with the rise of social justice issues, 2020 saw the announcements of diversity-focused funds. While newly-formed, some have deployed funding. A few highlights:

- Facebook – $10 million Black Gaming Creators Program

- Humble Bundle – $1 million Black Game Developer Fund

- Riot Games – $10 million Underrepresented Founders Program

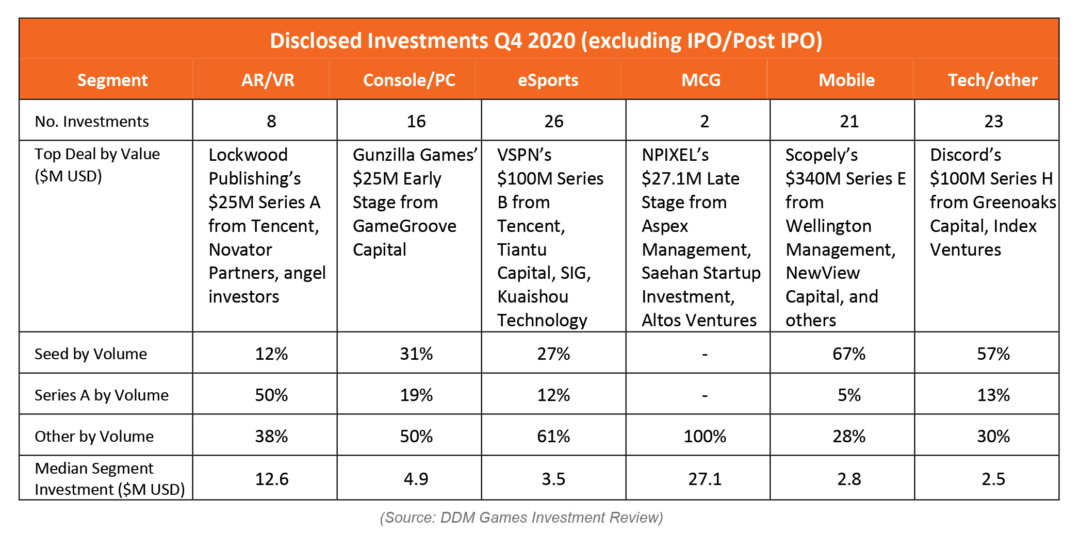

With over 100 investments tracked, Q4’s volume or number of deals was +19% YOY. The value of Q4 investments was 3% higher than Q4 2019 at nearly $2.2 billion. Console/PC and Mobile were the highest segments for investments, followed by eSports and Tech/other. While Q3 was driven by IPOs and Epic Games’ near $1.8 billion raises, Q4 was driven by post IPO equity raises (41%), which was led by Embracer Group’s $648 million raise in October. In addition, Scopely’s $340 million Series E was over 15% of the quarter’s investments on its own.

Among the funding stages such as Accelerator, Pre-Seed, Seed and Series A to later-stage funding rounds like Series G, Seed funding was the most common with a volume of 41 transactions. Series A was the next common funding stage with 14 transactions. The early-stage investments of pre-seed to Series A totaled over $220 million and 10% of the quarter across nearly 60 transactions.

M&As

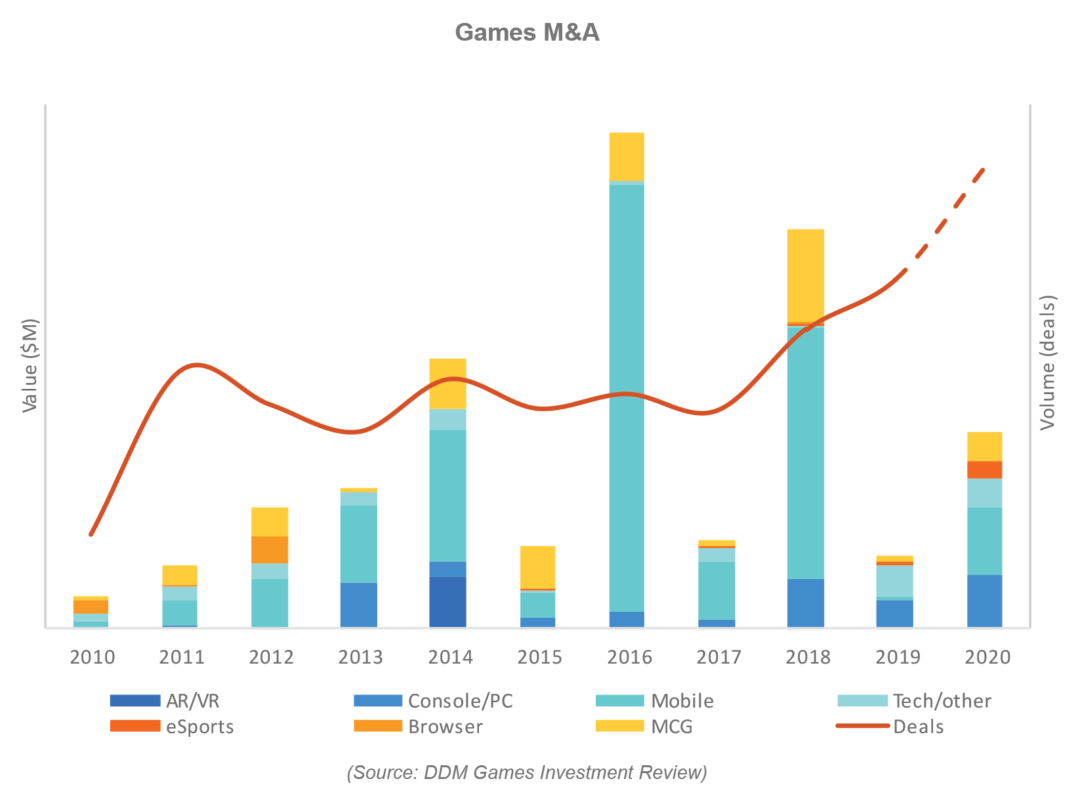

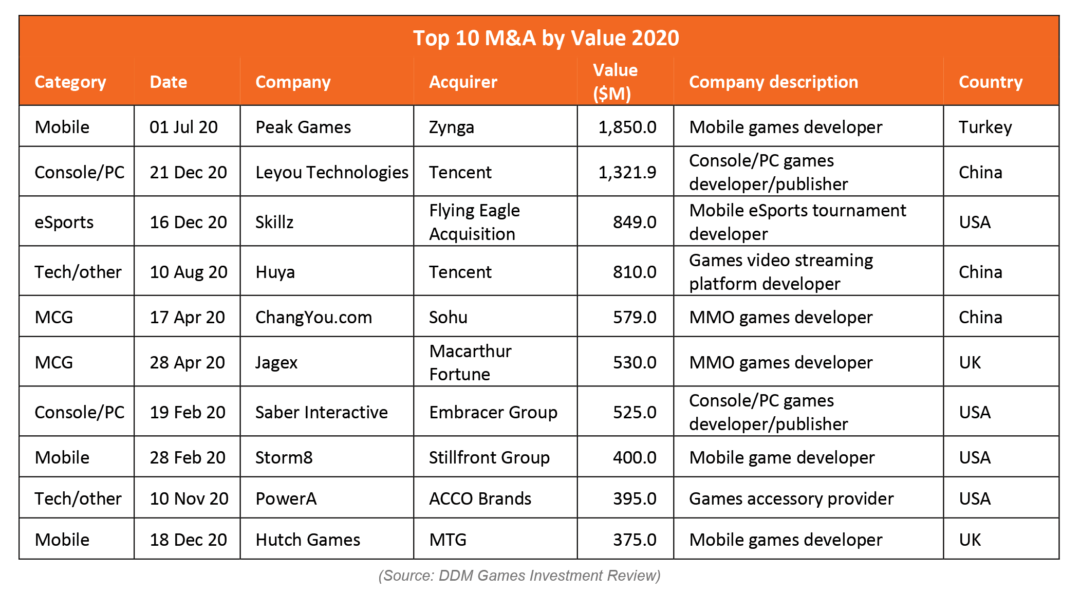

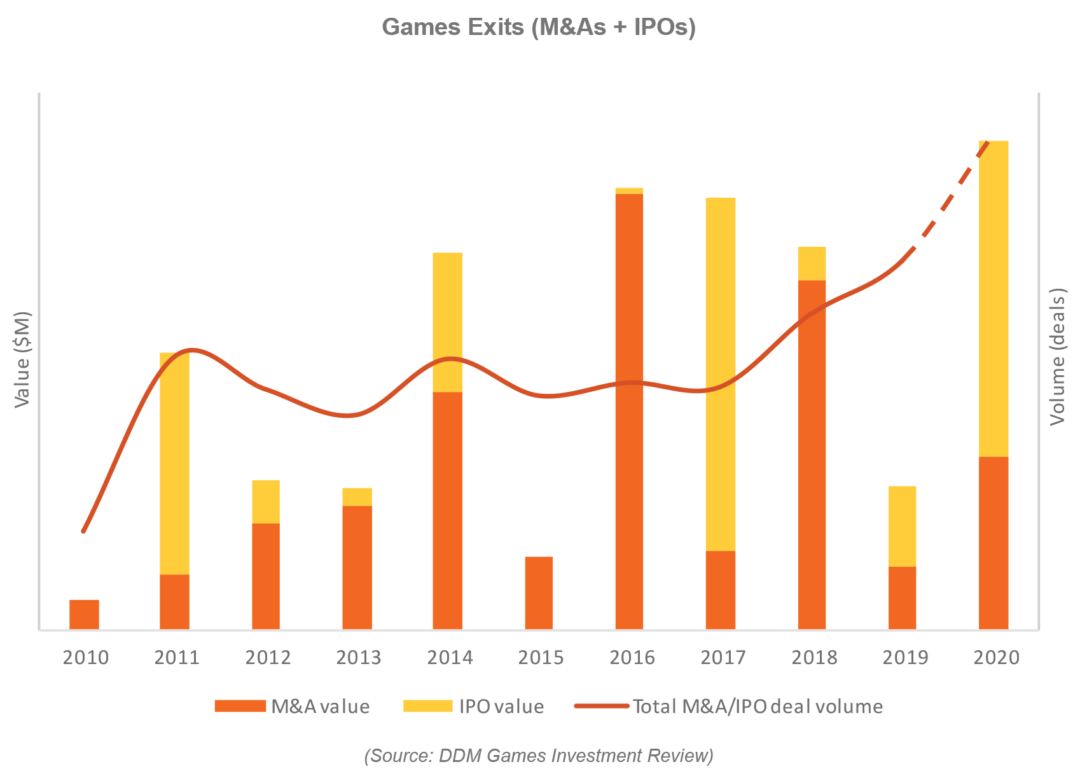

In 2020, mergers and acquisitions reached nearly $11.3 billion and set a new record for volume of investments at 220 deals, an increase of +32% YOY. M&A in Mobile (35%) and Console/PC (26%) segments comprised the majority of the year’s value, followed by MCG, Tech/other and eSports.

Large publicly traded companies drove the top acquisitions of 2020.

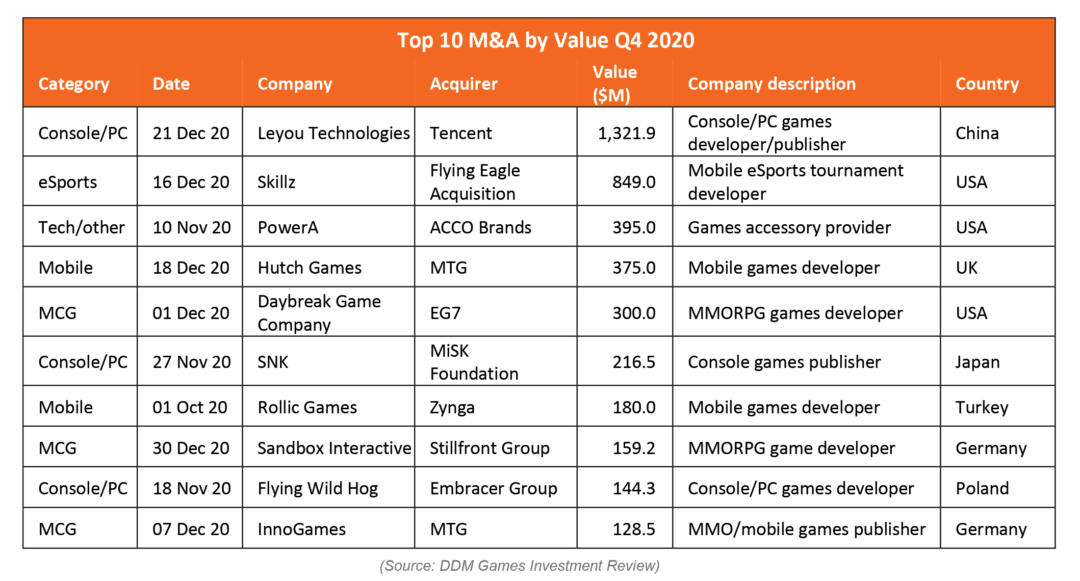

In Q4 2020, we tracked over 75 acquisitions and mergers, +93% increase YOY. The total value of disclosed deals for the quarter reached approximately $4.6 billion, 41% of 2020’s total value of disclosed deals. Console/PC and eSports were the highest segments by value, followed by Mobile and Tech/other. Tencent’s acquisition of Leyou Technologies at $1.3 billion was nearly 30% of the quarter’s value. Embracer Group continued its strong appetite—announcing the acquisition of 13 companies, three to close in Q1 2021.

Exits

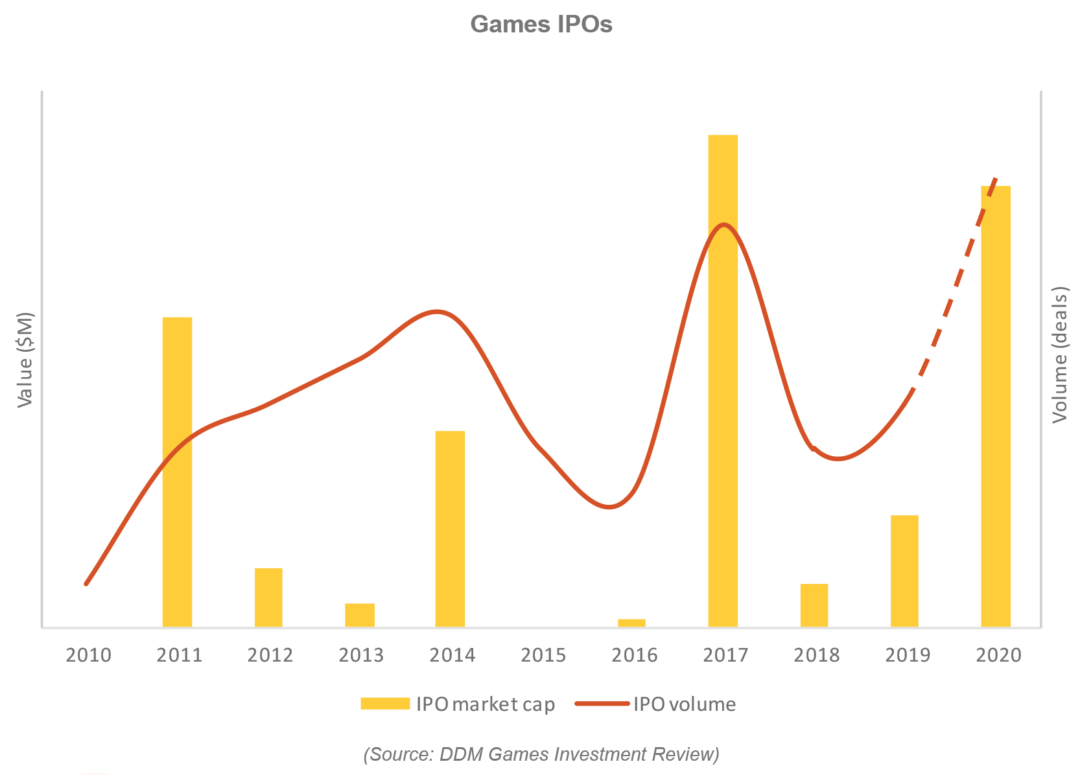

Four companies held IPOs in Q4 bringing the volume of IPOs for 2020 to ten: Thunderful Group, People Can Fly, Guild Esports and Playside Studios. This is the highest number of IPOs in a year, surpassing nine companies that went public in 2017! The largest in the quarter was Thunderful Group’s debut on the Nasdaq First North Premier Growth Market, raising $154 million with an initial market capitalization worth $402 million. Total market capitalization from all IPOs in Q4 was nearly $918 million. The total market capitalization for 2020 totaled $20.6 billion, which was 4x 2019 and which has continued a nine-year trend of two slower years followed by a breakout year.

Lifted by market capitalizations, the exit value of M&As and IPOs for 2020 reached a record $31.8 billion. The value of M&As alone in 2020 surpassed the total value of 2019’s M&A + IPO value by 20%.

This quarter, three more companies became public through reverse mergers: Skillz, Code Red Esports and Luckbox. Skillz’s reverse merger valued at $849 million with Flying Eagle Acquisition made headlines outside of the industry because it is the 6th SPAC or “blank check” Special Purpose Acquisition Corporation from noted investors Harry Sloan and Jeff Sagansky. They previously took DraftKings public via Diamond Eagle Acquisition and recently announced a new SPAC, Spinning Eagle Acquisition, with a target raise of $1.3 billion for its IPO.

2021

2020 was a record year for key aspects of the video game industry: player engagement, company revenues and investment activity. 2021 promises a continuation on all fronts as well.

We are optimistic that investments in games will continue at a healthy pace this year. Stay-at-home guidelines are expected for much of the year worldwide, which means continued high player engagement as games have proven to be of entertainment and social value as well as easily and digitally accessible on any device. This results in higher company revenues combined with sizeable venture funds that are partially fueled as people seek higher returns in a low-interest rate environment, which means more capital is available for investing.

On the M&A side, we expect acquisitions to continue at a robust pace. Two strong deals are expected to close in the first half: Microsoft’s acquisition of behemoth developer/publisher Bethesda’s parent company ZeniMax for $7.5 billion and Electronic Arts’ acquisition of Codemasters for $1.2 billion. The strong launch of a new console cycle plus increased competition in a tight “attention economy” has applied pressure on major players to build or strengthen their content and technology for seamless gaming experiences.

As previously observed, on exits, IPO cycles tend to work in three-year rotations with one high year followed by two lower years. In a typical cycle, 2021 would be a low year; however, 2021 is already off to a strong start with Playtika’s $1.9 billion IPO in January and Roblox’s upcoming DPO after it already raised $520 million in a Series H round at a $29.5 billion valuation. Traditional IPOs and acquisitions were the most common associations with an exit, but we expect to see this broadening as companies go public through SPAC/CPC reverse mergers and DPOs.

– –

The Q4 2020 report is now available for purchase: $499 per single quarter or $999 for an annual subscription. In addition to our industry forecast, the report contains a complete list of investment/M&A transactions from the quarter as well as expanded lists of the quarter’s top transactions and investors. For more information on our Q4 2020 report or DDM’s Game Investment Review, visit www.ddmgamesinvestmentreview.com or e-mail data@ddmagents.com.

Follow DDM’s Games Investment Review on Twitter at @gamesinvestment.